Want a quick response to the PCB assembly RFQ? Submit the full package of details.

Design projects that are actually completed with time to spare are few. We do what we can, but breaking new ground invariably uncovers a few snakes in the brush, and dealing with them takes time. That means that the next step – production ramp – starts behind schedule. At that point you need to get assembly quotes back ASAP so a choice can be made and the trigger pulled to get product flowing.

Some contract assemblers could provide a working number within a few days, but it would come with a list of caveats and unknowns and escalator clauses. Do you really want to commit to the program manager, the CEO, or worse, the market, with a number that guarantees a loss of profit (bid too low) or a loss of sales (bid too high)? Not if it could be avoided, of course. So let’s start by pulling together the documentation that engineering has, plus the implementation that marketing envisions, plus the ramp time the boss has in mind.

- Kit build (labor only), turnkey (labor and all materials), or a blend?

- Build, release, and EAU (estimated annual units/usage) quantities.

- BoM (bill of materials), including off-the-shelf part number, source, tolerances, alternatives, and count. Note those that are OEM-provided.

- If a component is obsolete, should it be broker-sourced, replaced or reengineered?

- OEM, EMS, or outside service to program ICs?

- PCB Gerber files, including board specification(s), quality level, panelization (x-outs OK?), and certifications (RoHS, ITAR, etc.).

- 3D CAD drawings with specs of custom parts (including the PCB) and current sources (if any).

- Assemblies supplied still in an array, as individual boards, or in final enclosures?

- Final assembly procedures required: conformal coating (type), potting, ultrasonic staking.

- Post-assembly procedures required: burn-in, temperature cycling (powered or unpowered), cycles and duration.

- QC testing: limited, AOI, fully functional; are test hardware and software provided?

- Golden sample and schematic available for test setup and aesthetic comparison?

- Packaging required (ESD, padded, consumer boxed, quantity per carton, etc.)?

- Percent shipment overage/underage acceptable?

Planning, quality and professionalism do not cost; they pay. Even with this list, questions might occur, but expect fewer interruptions to track down missing details and a more realistic cost, faster.

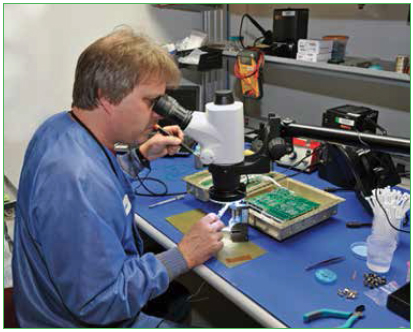

Figure 1. The EMS should take adders such as manual assembly into the equation.

Robert Simon is a veteran of technology development and marketing, having worked R&D and marketing for electronics, polymer, and metal companies, including Bayer AG of Leverkusen Germany and Battelle Memorial Institute of Columbus, Ohio, before founding USTEK Inc.; r.simon@ustek.com.

Why DIY machines will ring up big sales for some EMS/ODMs.

Self-service intelligent kiosks have evolved over the years, gaining increased functionality, yet have their origins in traditional food and beverage vending machines. These machines were originally electromechanical in design, but now are largely electronic today, with multiple embedded modules and communications functions integrated into the design.

The word “kiosk” is today used to describe a variety of user-interactive dispensing systems that can include ATMs (automated teller machines), POS (point of sale) devices, gaming/arcade equipment, and a variety of self-service systems within the transportation, retail and product goods industries. Each year, these kiosks become more technically advanced in terms of the kinds of merchandise they can handle, the variety of payment options they can conduct, and the new ways of communication interaction (e.g., video, Wi-Fi and near field communications).

In most cases, these features are application-specific to each market. For example, in the ATM market there is need for counterfeit recognition, bill paying, and in some situations, interactive video. In the gaming industry, there is demand for new forms of gambling/betting online for cash verification and interactive forms of communications for play. Self-service kiosks can now distribute a wide variety of merchandise, including food, beverages, DVDs, batteries, and many kinds of consumable goods.

In all cases, the functioning hardware needs to securely dispense, transact and sometimes collect products, all on a standalone, self-maintaining, self-diagnosing basis. This requires sophisticated product design skills, as well as excellence in manufacturing.

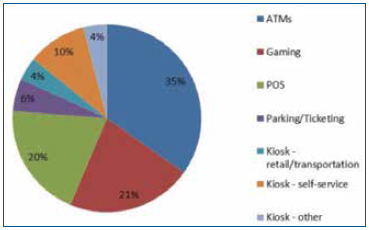

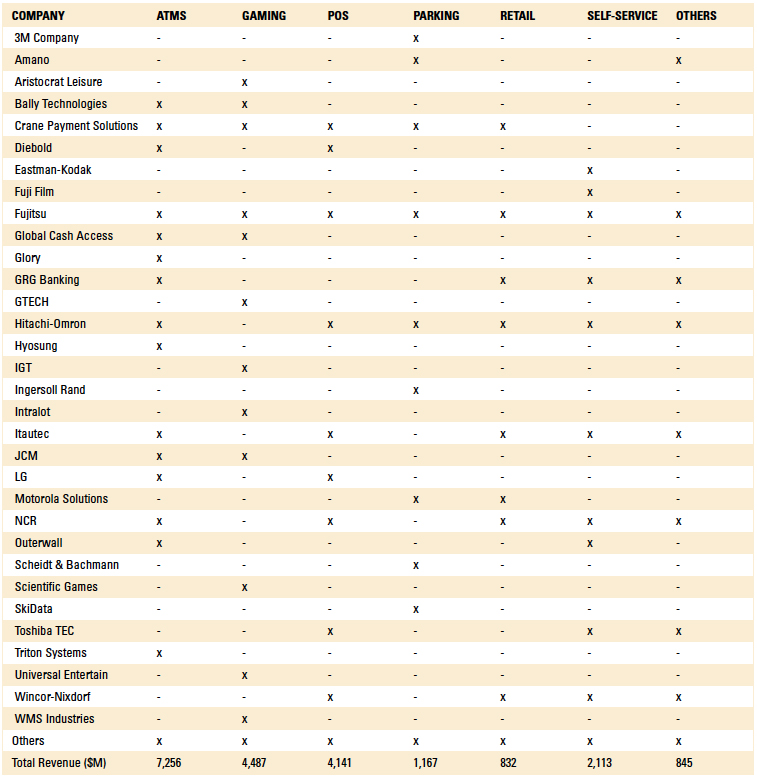

Based on the number of suppliers within each product segment, the market for the assembly of complex kiosk systems, New Venture Research estimates the total market assembly cost was approximately $21 billion in 2013 (Figure 1). EMS subcontractors account for approximately 21% of all product builds, mostly in the gaming and self-service kiosk market segments. OEMs account for the remaining assembly being done in-house, as there are high barriers to entry that pertain to industry hardware functionality and legacy systems, which for the foreseeable future will remain in the control of the OEM (Table 1).

Figure 1. Complex kiosk market assembly by product application ($21 billion), 2013.

Table 1. Total Assembly COGS for Complex Kiosk Systems by Product and Supplier, 2013

A number of EMS suppliers serve this marketplace on a subcontract basis. The majority of manufacturing performed today is PCB assembly, yet firms such as Flextronics and others offer full-system assembly, including reference designs, IP technology, and systems integration and product differentiation. Vice president Dave Gonsiorowski claims Flextronics has completed over 200 projects in the complex kiosk market segment. To this end, the company has received accolades from Redbox Automated Retail (a division of Outerwall that makes DVD rental kiosks), which has deployed a reported 36,000 transaction stations. Concerning industry evolution, he remarks, “You’re seeing convergence for sure. Also, the equipment is getting smarter and is part of the ‘big data’ movement. These systems can generate an enormous amount of information. They can track any of the information that the customer is using from these systems. So telemetry, big data and smarter equipment and self-healing: these are all things that the equipment can do now. We’re finding that the shoppers want to shop their way, when they want it and where they want it. The retail marketplace has a number of these products, and they all operate and communicate with each other in many ways.”

Regarding industry supplier composition, Jeff Doerr, senior manager of business development at Flextronics, points out, “The industry is made up of a handful of large OEMs that specialize in niche markets with niche products. These firms are developing technologies for their own consumption. There are a number of smaller kiosk integrators with revenues ranging from $1 million to $50 million that tend to focus more on integration of existing technologies. Unlike OEMs, these companies typically outsource all manufacturing/painting, then bring components, enclosure, etc., in-house for assembly. Typical projects range from one to 200 units, often with some level of customization, but usually are not very complex. Our advantage is that we are a world leader in the design, manufacturing, service and logistics of these technologies. We get to leverage our experiences in all areas of design and manufacturing.”

Sinocan is an Asian OEM manufacturer positioning itself as an ODM of complex kiosk products. Similarly, Kontron (a designer and manufacturer of embedded printed circuit boards) has strategically partnered with Plexus to offer unique ODM/OEM services for complex kiosk solutions. Foxconn is reported to have an ODM design group (FoxKPC) focused on POS and ATM products. Jabil has considerable experience in ATM/POS card readers, cash dispensers, large-form kiosks, and multifunctional automation equipment. Benchmark Electronics also has its eye on this market through its joining of the Intel Systems Alliance group to develop its business in the field of embedded computing, as do Sanmina-SCI and Celestica.

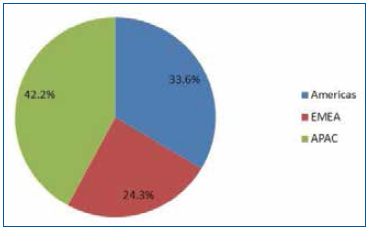

Figure 2 summarizes the total assembly COGS for complex kiosk systems by geographic region in 2013. These figures were calculated by examining each company’s sales and manufacturing operations and making estimates of production by region. APAC (Asia/Pacific, Australia, China – includes India) accounts for the largest production base, followed by the Americas and EMEA (Europe, Middle East, Africa). While APAC leads in product assembly, the Americas accounted for more than half of all EMS production in 2013.

Figure 2. Total assembly COGS for complex kiosk systems by region ($21 billion), 2013.

ATMs. ATMs account for the most feature-rich, complex kiosk systems, as well as the most extensive installed base. As with most products, they can come in different configurations and cost, with bare bones models representing approximately $2,500 in assembly value and as high as $30,000 for high-end systems with a variety of features (counterfeit detection, cash recycling, video interface, multiple currencies, etc.). Lately, cheap Asian designs have been making their way into the market, offering opportunities for installations in new locations not previously available.

The internal bill counting and dispensing mechanisms are the critical features to the ATM, as cash must be recognized, verified, sorted and capable of being returned. State-of-the-art end-systems image each note (both sides) and can recognize and capture counterfeit bills. Prices for systems are largely determined by how many bills the ATM can manage, with low-end systems capable of managing 1,000 bills and high-end systems capable of managing up to 12,000 bills.

The leading ATM OEM companies include GRG Banking (China), Diebold, Fujitsu, Glory (Japan), Wincor-Nixdorf and NCR. Respondents interviewed indicated that the market was growing very strongly, at more than 10% a year, largely in developing economies where cash is king. Cashless solutions in the developed countries are an emerging market, but there are many countries such as Russia, India and China where cash is still the preferred payment option. In many cases, people are uncomfortable with cashless payment solutions, but may use an ATM kiosk to pay bills and obtain products or services. Asian suppliers dominate this TAM by more than half.

Bessam Estaitieh, director of marketing at Crane Payment Solutions, observes that the most promising markets are in emerging countries like India and China. “The options from the kiosk depend on the country you are looking at. For example, in India in suburbs or rural areas, it might not make much sense to deploy cashless options, so cash is still the preferred method of payment. Russia is a mature country when it comes to bill payment kiosks, so growth is more moderate there than other countries. China is growing strong, and India has over a billion people who are cash-oriented. Another variable is the model, where in Russia it is a multi-operator solution versus China, where it is a single operator solution. For example, there are two wireless providers in China, the largest one with 750 million-plus subscribers that can afford to deploy its own kiosks. The rest of the world has smaller operators; it becomes a business case decision based on maturity and experience, in terms of single vs. multi-operator model. Each country is unique. You can’t paint the world with one brush; it depends on its history, government, and how capitalistic it is, so you have to develop a geographic approach.

“On the kiosk side, most of the market globally is in the emerging world. I cluster kiosks into four distinctive geographic areas. The most mature kiosk market is Russia, followed by China in terms of deployment size. The US is third, followed by RoW. The Russian culture is very much focused on cash and anonymity, and they prefer to use kiosks. They provide a good model for the rest of the world. For example, there is a kiosk OEM that provides the kiosk; then there is an operator that purchases the kiosk and runs it to enable payment for service from multiple providers. A popular application is to top off your cellphone or pay your utility bill and other things. Each cellphone company or utility doesn’t have to develop its own kiosk, which would not be cost-effective. It simply connects to a payment network, and the kiosk operator charges a per-transaction fee.”

Terra Nofsinger, AVP, merchant sales specialist for Bank of America, notes that the ATM selected by the merchant depends on how many notes the merchant wants to be able to transact. “If you think about an ATM dispensing 3000 notes a day, which may take two or three salaried tellers the same amount of time and work to do, it becomes a situation in which the ATM could have a payback of several months. It sounds bad to be replacing workers with machines, but in fact these ATMs are much more accurate and cost-effective when compared to human labor. They don’t take coffee breaks, and they work 24 hours a day.”

Gaming. Manufacturing equipment for gaming companies (those engaged in slot machine, arcade, and cash acquisition/exchange systems) is a vast industry that has been well-penetrated by EMS companies, and is still a growing market due to technology development. Electronic gambling in North America has matured (blackjack, poker, bingo, etc.), but in Asia (and Europe to a lesser degree), it is growing dramatically as the gambling market expands. In most cases, however, gamblers prefer interacting with live people than with machines in this region.

The gaming market is constrained in a similar way to the ATM market by people who prefer to transact exclusively in cash. Cashless solutions that involve credit/debit cards are still developing in the emerging economies, but gaming kiosks (frequently ATMs) that accept credit are becoming more common and trustworthy as the world evolves toward electronic systems. Solutions involving credit devices that exchange cash for winnings, or ticketing credits, are becoming increasingly commonplace, and market growth appears to be emerging principally in Asia, where the market is expanding so rapidly.

Outsourcing of gaming equipment assembly has been robust for many years in North America and Europe. Many of the contracts have gone to second and third tier EMS suppliers because of the complexity of the assembly requirements, which often involve a high degree of electromechanical production capabilities, but also because of the vertical niche nature of the industry. Often, large gambling companies prefer turnkey assembly capabilities of smaller and local suppliers that specialize in understanding the technical demands of federal and state entities for transparency and legality. As this varies considerably between country and state, compliance often becomes a deciding factor.

POS. Point of sale (POS) equipment normally includes a wide range of cash registers and check-out stations found in today’s retail outlets. A complex kiosk POS system can be seen in self-checkout stations at local grocery markets and, increasingly, at retail stores. Although vending machines might be considered in this category, we are avoiding this avenue because of the commodity-like nature of these systems.

NCR, Wincor-Nixdorf and Toshiba have long been leaders in POS equipment, and the development of complex kiosk POS solutions has naturally emerged from this expertise. The market naturally split between commodity cash register machines for retail and higher-end, networked systems for large-scale super-store operations that are more comprehensive in terms of features and reliability.

EMS assembly of complex POS kiosks has been constrained to date, as the manufacturing of these solutions involves the integration of numerous sub-systems, including barcode technology, cash handling equipment, credit/debit card transaction, display/audio technology, communications, and the weighing of purchased items. While these systems are becoming more commonplace, they are rarely turnkey in nature and thus require a considerable amount of customization and systems integration. NCR and Wincor-Nixdorf have been shown to be the most progressive by subcontracting PC board assembly where their systems are sold, and Flextronics has shown to be the primary supplier of customized solutions.

Randy Fox, vice president of currency handling and identity product solutions for Fujitsu’s cash management and recycling operations, offered several comments concerning the evolution of the industry. “People have been talking about cash going away for the last 30 years, but the simple fact is there is more cash in circulation today than ever before. We see the need for cash, and the need for cash handling, growing. There is certainly growth in first-world markets like the US for cash management. Cash is discreet, private and is not regulated, particularly in the second economies where you have a lot of immigrants who do not feel comfortable using credit instruments. We look at the market growing in terms of applications such as gaming and hospitality. Also retail and banking, but growing in markets where cashless hasn’t been used. All of the kiosk vendors are asking that question, but you have to understand that every market in every application is different.”

Parking/ticketing. Parking and ticketing kiosks are a vertical application because of the technology sophistication, which is of the order of an ATM. Yet these solutions must operate in harsh conditions and environments. Leading suppliers include Fujitsu, Ingersoll Rand, Amano and 3M.

Aaron Mills, a marketing executive at 3M, perceives the market in this way: “What we focus on today is primarily what is called off-street parking. So the market is split pretty much 50/50 with off-street parking and on-street parking. The on-street systems are getting more complex. The technology you’re seeing now – there is a box or kiosk that you go up and pay. There isn’t a parking meter anymore. There is just a number and a pay-and-display system. So it’s evolving, but we don’t make them. The on-street parking is almost totally owned by the cities.

“Off-street parking systems have a lot more advanced technology. It’s mainly garages, but there are also parking lots with a gate. There is also free parking that needs to be controlled. For example, in the hospital, there are doctors and nurses and people who need to park and gain access, so you scan your card and the gate will open. Sometimes, the hang-tag that you find at universities works by RFID. Most of what we do is on the revenue control side with paid parking.”

Industry averages show that a typical parking system in a garage consists of two lanes in and two lanes out. Some solutions are fully automated, while others decide

to use a cashier in the lane to accept payment. Equipment costs for an automated, two-in, two-out system range from $60,000 to $100,000, depending on system complexity.

Kiosks – retail/transportation. Retail and transportation kiosks are becoming increasingly common in stores, hotels, sports centers, hospitals, restaurants, courthouses, delis, museums, airports, subways and train stations. As such, they tend to be more application-specific, such as issuing a boarding pass at an airport and transacting a debit for the luggage fee. Because they frequently do not handle cash, these kiosks cost less and are less complex to build. A number of suppliers serve this market in all regions across the world. Leading suppliers include Fujitsu, GRG Banking, Wincor-Nixdorf, NCR and Triton.

Outsourcing of these so-called lightweight types of retail kiosks is becoming more common. While not commodity in nature, they can be assembled with standard components, including scanners, displays and printing technology, as opposed to a much more expensive and customized system.

Flextronics’ Gonsiorowski summarizes the market in this way: “Depending on the niche of this segment looked at, you will see different trends. Information kiosks tend to be commodity, as are digital signs, mobile devices and tablets. Established markets like ATMs and gas pumps tend to still be integrated in-house with the use of outsource providers offering components. Automated storefronts, on the other hand, tend to be custom. The brands are very interested in having the machines match their brands and deliver interactions consistent with their brands. They are very particular about how they interact with customers, and want the systems to be customized to the experience they want to deliver. We also see a trend where brand companies working with their creative agencies are coming up with new and innovative concepts for self-service. These companies are trending toward outsourced strategies.”

Kiosks – self-service. The most popular and fastest growing market for complex kiosk systems seems to be self-service solutions. Well-known products include DVD rentals (RedBox/Outerwall, Inc.), automobile rental stations (Hertz), and more recently battery purchasing/recycling (BETTERY – now discontinued), convenience products (Store24), bicycle rentals (B-Cycle), electrical recharging stations (Charge It Spot), and represent an attractive and sizable market segment with emerging companies that are brimming with ideas.

Outsourcing of assembly of self-service kiosks is more extensive than any other market segment. This is because the largest region for these systems is found in North America, where OEMs do not want to manufacture and need a good partner to assists their product launch. In some cases, the subcontractor is not an EMS company but an OEM/ODM with its own branded product and intellectual property that it wants to license. As such, this market is growing very rapidly in North America.

Demand for self-service kiosks appeals to retailers who are always looking for ways to boost sales and install offerings that appeal to customers that bring them back to the store. These systems are designed so that all communications are completely secure in terms of credit card transactions, inventory management and software updates, often handled wirelessly over a cellular network. Flextronics’ Gonsiorowski states, “There are still markets and good reasons for some solutions to be a mix of automation and people.”

“I believe what we have learned about self-service over the past 15 years is that the equipment can provide the consistent transactions and, in many cases, more information. There are still some products and services where human interaction is still very important. In these cases, we see a trend where the human is there to provide the human interaction, but the equipment is there to ensure the information and transactions are delivered consistently.”

Trying to decide on a make vs. buy business model, suppliers sometimes create a hybrid solution that involves standard components and modules such as displays and credit card transaction devices, with custom dispensers that accept and recycle products to returning customers. In these situations, there are companies that specialize in retail automation solutions that leverage many existing designs to avoid starting a project from scratch. The mix of original and reused technology is frequently 40:60 for existing vs. custom solutions.

Fujitsu’s Fox summarizes the state of the industry this way: “The componentry is getting more and more miniaturized, so we can get into new applications in which the price point is coming down. There is the advent of new, miniaturized, low-cost cash dispensing technologies. There certainly is growth in cashless payment, such things as mobile POS and electronic commerce. The pie overall is growing. All boats are being lifted because the pie is growing.”

Randall Sherman is president and principal analyst of New Venture Research Corp. (newventureresearch.com); rsherman@newventureresearch.com.

A new study of nanocoatings allows users to visualize solder paste flow under the stencil.

Do nanocoatings really extend stencil underwipe intervals? As part of a larger stencil study we were performing for SMTAI,1 we decided to include a quick test. We’d take two of our nanocoated fine grain stencils and run one print per wipe vs. 10 prints per wipe on a really complex test vehicle. The Process of Record (POR) for this PCB is a vac-dry-vac wipe after every print, based on prior experimentation before the nanocoating was introduced to the process. We were almost certain that a tenfold extension of wipe intervals would show a definite decline in print quality, regardless of the coating’s influence.

The results were amazing: not only did not wiping for 10 prints not deteriorate print quality, it actually improved it! The 10 prints with no wipe produced higher yields and better repeatability than the 10 prints with a wipe every cycle. This was no fluke. It happened twice in a row, using two different generations of SAMP nanocoating.

The surprising results ignited a burning curiosity about the performance improvement. The numbers were clear: yields were higher and print volume variation was lower, but we wanted to see what was going on. We devised an experiment to help visualize the interaction between the solder paste flux and the stencil by nanocoating half the stencil’s print area and adding UV tracer dye to the solder paste.

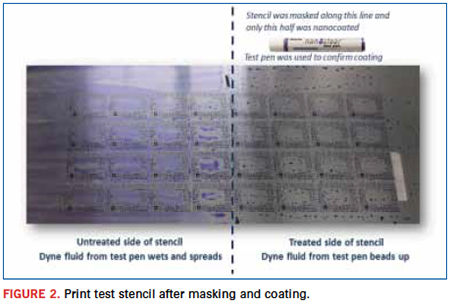

Our suppliers were extremely supportive of our investigation. Indium added UV tracer to Vicor’s usual solder paste so we wouldn’t have to dial in a different material just for the tests. Aculon supplied plenty of NanoClear coating packets and a dyne pen to help develop a robust masking and coating process for our test stencil. Kyzen provided stencil wipes presaturated with a solvent that was tested and approved for both Vicor’s paste and the nanocoating. With all the materials and test vehicles readied, all we needed was some line time to run the tests.

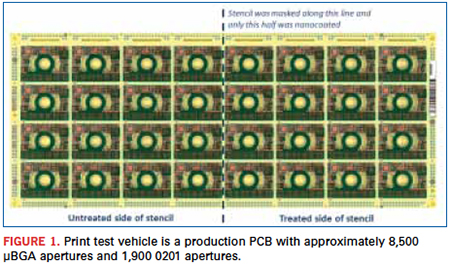

A spare, relatively new, uncoated stencil from a favorite test vehicle – shown in Figure 1 with almost 15,000 apertures crammed into a 3 x 7" print area – was essentially divided into two by temporarily masking half the print area and nanocoating the other half. The PCB is a 4 x 8 array. Using a stencil that was half coated and half uncoated enabled head-to-head comparisons on adjacent 4 x 4 arrays (Figure 2). By holding every other print variable constant, the effect of the nanocoating on stencil cleanliness, print definition and stencil under wipe effectiveness was isolated and obvious. Several tests were executed, and the visible differences were documented with a digital microscope and a UV flashlight.

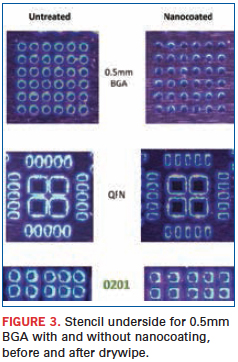

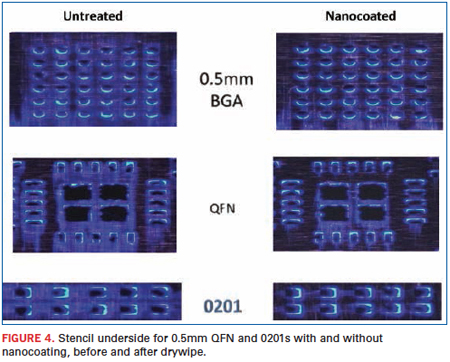

First, 10 prints with no underwipe. The flux on the bottom of the stencil fluoresced under the UV light to show where it flowed during the printing process. Figures 3 and 4 show the bottom side of the stencil for 0.5mm pitch BGAs, 0.5mm pitch QFNs and 0201s. The top two photos show the underside of the stencil prior to wiping. The apertures on the untreated area demonstrated much more flux wicking and smearing than those in the treated area. In many cases, the edges of the treated apertures are visible, indicating considerably better containment of the paste than the untreated side, where some apertures are already bridged by flux.

The next test was a vac-dry-vac wipe after the 10 prints, shown in the bottom two photos of Figures 3 and 4. Wow! While underwiping removed the stray solder spheres that impede gasketing from the bottom of the stencil, it did not remove the flux. Instead, it smeared the flux all across the bottom side of the stencil.

Again, the effect of the nanocoating was abundantly clear: the coated area of the stencil responded much better to the dry wipe than the uncoated area, although it still showed some flux residue.

The 10-print test with a vac-dry-vac wipe after every print caused more flux smearing on both areas of the stencil, but the nanocoated side showed less smearing and less paste trapped in the apertures. When a solvent wipe was mimicked by cleaning the bottom of the stencil manually with the presaturated wipes and immediately running the printer’s automatic vac-dry-vac wipe cycle on it, the nanocoated area cleaned up beautifully, while the non-coated side still fluoresced with telltale flux residues. Unfortunately, the microscopy equipment did not capture the images very well; upgraded photographic methods are planned for future tests.

We started the experiment with the hopes of documenting some visible differences in the solder paste-stencil interaction between the nanocoated and non-nanocoated areas. After weeks of planning, enlisting the help of our suppliers and scheduling run time, we were absolutely elated to see such a contrast between the two conditions. But there was something else we were hoping to see in this experiment also – a difference in the paste prints themselves. Starting with our first study on nanocoating two years ago,2 we’ve been noticing that the nanocoated stencils have produced slightly lower transfer efficiency (TE) than uncoated stencils. We have hypothesized that the lower TE is due to crisper print definition, but have yet to formally investigate it.

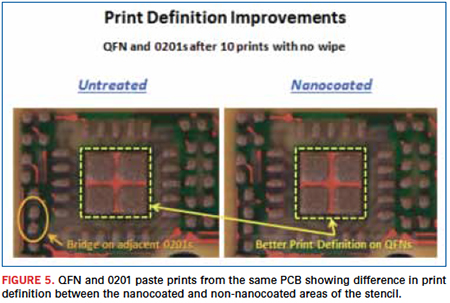

In addition to photographing the bottom of the stencil, the paste prints were photographed. The objective was to look specifically for differences in print definition, but it was not possible with the BGAs. At a maximum magnification of 40X on the digital microscope, the top-down view was no help, and the scope’s autofocus function did not work well on the angled PCB for oblique angle views. The photos of the QFNs and 0201s, however, undeniably demonstrate the print definition differences.

The QFN and 0201 prints shown in Figure 5 were taken from the 10th print with no wipe, and correspond to the apertures shown in Figure 3. The effect of the excess flux/paste smearing on the bottom of the stencil was obvious: a bridge connected two pads from adjacent 0201 components, and the difference in print definition was easily observable in the QFN’s ground pad. It’s only one data point, but a very strong one that supports the hypothesis that the lower TE may be associated with crisper print definition, and necessitates further investigation of the relationship.

All the details of these tests will be published at the IPC Apex conference next month, and as mentioned, the next round of experiments is in the planning phase.

It will take a closer look at the relationship between print definition and TE by taking higher magnification photos of print definition and using the SPI system to capture 3D models as it measures paste volumes. The higher resolution imaging will also be used to depict the effects of different wipe parameters on nanocoated and non-coated areas of the stencils. Two groups of researchers will combine their collective findings on coatings and wipe processes to formulate and execute a comprehensive DoE.

The relationship among stencil coatings, cleanliness, cleanability, print quality and cost savings is currently understood at only a very basic level. There are many

improvements and tradeoffs to characterize, both obvious and subtle, and the mathematics of the relationships will emerge as laboratory research and production implementations continue. This we know for sure: this affordable, accessible coating that wipes on in a matter of minutes makes a big difference in the print process – one we can all see.

Chrys Shea is founder of Shea Engineering (sheaengineering.com); chrys@sheaengineering.com. Ray Whittier is principal SMT process engineer at Vicor (vicr.com).

Getting the right temperature is a balancing act, at times requiring fine juggling.

Creating a thermal profile isn’t as straightforward as it once was. PCBs are populated with a growing assortment of new packaging and technologies, introducing new challenges and their associated tradeoffs when it comes to creating the thermal profile. Usually, a conventional board consists of a mix of passive and active components in traditional packaging. Increasingly, boards are populated with µBGAs, µCSPs and µQFNs, as well as the larger BGAs, CSPs, and QFNs. Plus, there is continually smaller packaging like 01005s for passive devices.

Creating a profile for a board like this poses perplexing issues, since larger packages require more heat compared to smaller ones, and there are special considerations when it comes to package-on-package (PoP). Finding a temperature setting that’s acceptable to both larger and smaller packages, while juggling tradeoffs and special considerations, is a balancing act. It’s critical not to overheat smaller packages to avoid solder bridging. On the other hand, more heat needs to be applied to the larger BGA packages for solid solder joints and to keep from creating open solder joints.

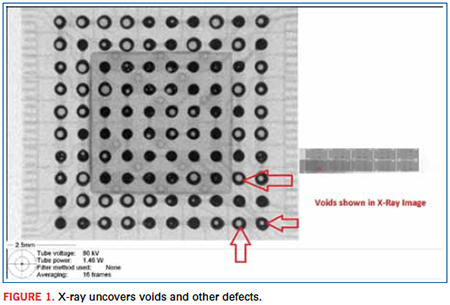

After creating the thermal profile, the first-article board is run through reflow to determine whether the profile is good. At this point, x-ray inspection can be performed on both larger and µBGAs to determine whether issues exist: for instance, voids and other defects (Figure 1), such as whether BGA balls have collapsed per IPC standards. That first board informs and defines adjustments needed to the reflow profile.

X-ray covers about 90% of the issues the process engineer views as a board goes through reflow. These x-ray visuals provide the roadmap for the type of adjustments that may be needed, such as a shorter or longer soak time or determining whether or not BGA balls aren’t collapsing. Then a higher peak temperature might also be needed for that particular board to reflow properly.

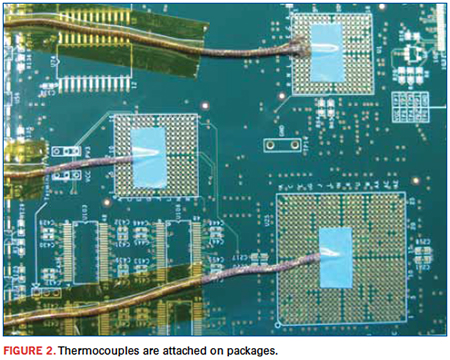

A variety of adjustments can be applied to the profile to accommodate large and small packages. In general, profiling involves making those adjustments on a board-by-board basis. The most common way to establish a profile is to first set a baseline and run it through the oven. To do that is a multi-step task. First, hermocouples are attached on these packages (Figure 2). To set the reflow oven temperature, a reading is taken to show the amount of heat these components

are exposed to when they go through the reflow oven at a certain speed. Once a reading is taken and the board exits the oven, the profile is refined by adjusting the pre-soak, soaking and reflow temperatures.

The right balance must be struck among soak time, peak temperature and reflow time. Soak time is fine-tuned to the critical components. A long soak time is normally not required for smaller packages. Larger packages, however, do need a longer soak time to provide sufficient time for paste flux volatiles to evaporate prior to reflow.

Part of that soak time review is to investigate differences in paste characteristics. These can drive the differences for each profile. Normally, for larger packages, the tendency is to target soldering issues by setting a longer and higher soak time. But at the same time, a lower peak temperature might be needed. This is done to avoid overheating smaller packages.

When profiling, ensure that peak temperatures are reached for the larger mass BGAs, but take care not to burn out the sensitive components. Simultaneously, temperature across the conveyor belt must be taken into account. That temperature can range anywhere from 2° to 5°C. Often, the edges of the PCB represent the coolest areas while in the oven. Therefore, they require even more heat if BGAs are placed on the edges of that particular board. For example, if a BGA on a particular board is normally set at the maximum peak temperature of 245°C, the tendency would be to bump it up. At the same time, however, keep watch on such components as electrolytic capacitors. For instance, by lowering their maximum peak temperature to around 235° or 240°C, that will prevent too much heat from being applied to those smaller components.

Also, railings on reflow ovens have to be taken into consideration. Temperatures closer to the railings tend to be several degrees cooler than the middle of the oven, thus having a huge impact on the profile. This can make the difference between a good and bad BGA reflow process.

There are several ways to resolve this. One is design and place BGAs away from the edge of the board. Ideally, BGAs will be located closer to the middle of the board. If this is not possible, an alternate approach is to make a reflow fixture for that particular board. The fixture would center the board in the oven to alleviate issues of cooler temperatures toward the edge of the board.

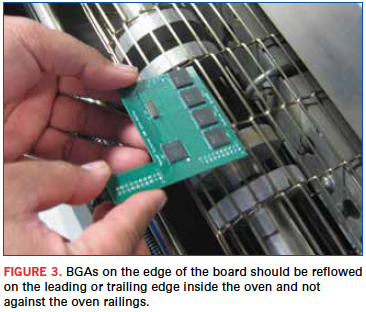

A major profile adjustment for process improvement is to turn that particular board 90° so that the BGAs on the edge of the board are either on the leading or trailing edge inside the oven, not against the railings of the oven (Figure 3).

Leveling the Heat

Take a PCB populated with BGAs, QFNs, CSPs and DFNs. Temperature readings are taken on these particular devices when a profile is being created. The reason is when higher temperature settings are applied on larger components, it’s important to ensure that the smaller components don’t overheat. Applying too much heat causes component failure or causes solder paste to exceed manufacturer’s required temperature readings. Efficiently and strategically spread the thermocouples across the board to achieve as accurate a reading as possible. This includes monitoring the middle and corners of the board.

Failure to achieve the right balance can lead to problems during testing or quality control. Some problems can be solder balls and delamination on the PCB. Solder balls usually occur when the board undergoes an excessive heating rate as it passes through the reflow oven. The reflow cycle is too long, and solder balls form throughout the board. Also, excessive heat can cause board delamination, compromising the reliability of the PCB.

Temperature setting is the trickiest part associated with balancing this trio of profile characteristics. Some components simply cannot handle higher temperatures or are highly heat-sensitive at certain temperatures. In the event a heat-sensitive component is used, the OEM should alert the assembler in advance and advise whether a SnPb or Pb-free profile is desired.

SnPb and Pb-free components are required on a board at times. Processing a Pb-free BGA based on a leaded thermal profile is certain to induce problems. A leaded solder’s melting point is about 25° to 30°C lower in temperature than that of a Pb-free material. In this particular instance, an open ball problem can result from using the wrong thermal profile.

The opposite is also true when processing a leaded board based on a lead-free profile, which requires considerably higher temperature. This mismatch can result in shorts or board warpage. BGA voiding is yet another defect that occurs. This is where the BGA is not 100% collapsed, and a void exists that results from one of multiple and different factors. A common adjustment to minimize voiding is a long, high soak and a lower peak temperature. The longer soak and high temperature is to provide sufficient time for the volatiles in the paste flux to evaporate prior to reflow.

Lack of BGA localized heating is another issue that might be encountered. This means that the BGA is not getting enough heat and the balls are not collapsing. Sometimes the thermal profile is not optimal, thus creating BGA voids. For example, a BGA that is typically heated to a maximum peak of 245°C might see the temperature increase slightly to ensure proper reflow.

PoP Profiles

Package-on-package (PoP) poses a new challenge for creating the correct and proper thermal profile for a PCB (Figure 4). In this case, there are certain pros and cons to deal with. As of this writing, there are two popular ways, and either one can be a contract manufacturer’s preference since there is no standard profile for PoP. One involves separately reflowing one component on top of the primary one at the rework station or in the reflow oven. This process is performed before the PoP is installed on the board, and a separate profile is created for that component only. Once the top components are loaded onto the bottom ones using the rework station, all PoPs are installed on the PCB, and the entire board is run through the oven. The assembler needs to consider placement accuracy, paste or flux dipping and reflow warpage as critical areas for PoP applications.

The second method is soldering both components at the same time. In this instance, they are reflowed through the oven together and with the board. That particular profile could be used for every board with similar types of PoP components on that particular assembly. But most important is the level of research performed to achieve the correct profile and the steps taken to create it.

The two methods of PoP soldering have their respective pros and cons. The two methods are rework station and reflow oven. The advantage of using the rework station for PoP is that it targets the heat at one particular area. Nothing else is reflowed on that particular board. Consequently, temperature settings can be adjusted only for that particular area. As far as the engineer is concerned, this is a real plus, since no other parts on the board are affected as the PoP is reflowed onto the board by itself. This process works best mainly for small production runs like prototypes or small runs of five to 10 boards.

The disadvantage is the limited number of rework stations on the assembly floor. Usually, there’s one or two. So, the issue here is meeting delivery schedules since this process is not well suited for large-volume runs, unless multiple rework stations are on the manufacturing floor.

The advantage of using the reflow oven for PoP is the ability to make large-volume quantity runs on the production floor. The disadvantage is the fact that it

profiles the entire board, not just the PoP component. This means all the components on the board must be taken into consideration. And they also go through a thermal cycle.

In this scenario the process engineer encounters different problems in terms of different components handling different temperature levels. Therefore, a profile is necessary for PoP components and other sensitive components such as CSPs, QFNs, and DFNs. In effect, a general idea of a proper profile and defining the right temperature settings represent the key objective here. Here, it’s not so much as trying for a perfect profile, but one that’ll work for a particular board without creating any further issues with any type of package, like BGAs, LGAs, or PoPs.

Simon Ilustre is a process engineer at NexLogic Technologies (nexlogic.com); info@nexlogic.com.

Is there a way to more tightly integrate materials and process development so as to accelerate the pace of innovation?

The electronics supply chain has evolved at a relatively slow pace and there hasn’t been an effective disruption to the operating method in nearly 20 years. The need still exists, however, for original equipment manufacturers (OEMs) to pursue a new way of creating a smarter, faster and better method to speed up the product development lifecycle in order to meet the demands of retailers and consumers. OEMs need a model that enables them to acquire increased control over the lifecycle while leveraging the ingenuity of the supply chain that supports their manufacturing suppliers.

In the past, suppliers have tried – and failed – to adapt the supply chain in order to speed innovation. These methods haven’t fared well in the market for a number of reasons. First, suppliers tried coming at it through a manufacturing approach, typically with a supply focus (either materials or equipment). Through this model, the materials or equipment created for assembling end-product were not always designed in a way where they could be implemented in the manufacturing phase; rather, they were engineered as standalones without taking the bigger picture into account. They failed to address questions such as: How will the solution interact with other aspects of the design? How does this impact the overall design process? What supporting materials, equipment or processes are needed in order to implement the new material? Because not all of these factors were consistently taken into account, OEMs missed out on including the latest technology into their products, and processes and suppliers had excess waste since their technology couldn’t be used.

Another reason some approaches failed is a lack of sufficient global distribution to reach the necessary customers in a timely manner.

Finally, some OEMs did not fully buy into the idea of working directly with a material or equipment supplier – that a design solution was just as valuable as a supply solution.

OEMs by their nature look for solutions that don’t yet exist. Although the EMS supply base has excellent solutions that exist today, and can offer high yield and steadily lower manufacturing costs, the industry as a whole is focused on process development, not product development. So how can we effectively speed innovation on the supply side without repeating the mistakes of the past?

One path forward is to develop and maintain stronger, tighter relationships throughout the supply chain, to collaborate in more efficient ways, and to communicate more effectively. H.B. Fuller’s strategy involves working in the very early stages with the OEM designer to come up with something unique. This angle targets both design services and materials, which is typically how end-customers approach new product generation.

H.B. Fuller’s acquisition of Engent is one step in that direction. This partnership has enhanced our ability to engage OEMs early in the design cycle and support programs at the systems level. The emerging technology required for the new product is developed by working closely with the OEM, typically on multiple continents, and with the OEM’s manufacturing partner. When the product is ready to receive the green light for full-scale production, H.B. Fuller deploys resources directly at the final manufacturing site, ensuring process support and a quality ramp-up of product manufacturing. This type of partnership streamlines the process for all parties involved in the supply chain. By leveraging Engent’s expertise in next-generation electronics manufacturing and technology services, as well as utilizing our own large-scale connections in the supply chain and global distribution capabilities, H.B. Fuller makes it possible for OEMs and suppliers to have a single source when it comes to global testing and developing. And by gathering all members of the supply chain in one place, improved communication and collaboration happens.

This new electronics supply model represents a shift in terms of how members of the supply chain interact and move products from concept to consumer. While the traditional model has suppliers mainly working at the manufacturing level – meaning they are focused on developing new equipment or materials – and are mostly independent of OEMs, this new approach emphasizes the entire supply chain coming together to work at the design (or “systems”) level. This is a significant divergence from the old model, where suppliers would develop groundbreaking new equipment or materials, but later learned that the assembler might not have the facilities or capabilities to use them in manufacturing lines.

Here’s how the new model works: OEMs present design challenges that are defined at the systems level. By having all members of the supply chain working jointly to solve these challenges instead of in silos, the supply chain is forced to expand its knowledge past what they sell. This gives OEMs the ability to speak at the systems level to the supply chain, thus speeding innovation and production processes through increased information transfer and better communication. In theory, this is just an ideal. To achieve it, the supply chain must interact both collectively and as independent groups within itself – from materials, components and adhesives to PCBs, manufacturing equipment, etc. In addition, all parties must act interdependently in the supply chain and attempt to proactively innovate on the OEM’s behalf. The knowledge gained and shared through working interdependently helps create a more efficient model for innovation because all parties are collectively designing products and materials, rather than just OEMs or suppliers.

Working together at the design level rather than the equipment or material level allows compatible OEMs, material suppliers and the rest of the supply chain to be more acutely aware of each other’s projects and ideas. This leads to improved collaboration, which in turn speeds the development and innovation process, satisfying both the OEMs’ and consumers’ needs. In short, all members of the supply chain work in concert to discuss and develop new design solutions. This method enables OEMs to achieve streamlined innovation, while suppliers use their increased access to OEMs to develop solutions they know the EMSs have the capacity to manufacture.

This new approach helps supply chain parties become smarter about how to structure their business operations in efforts to better collaborate and communicate with one another. Each member in the supply chain must learn how to best interact with each other and share crucial information to help optimize the production process in the changing electronics manufacturing world.

H.B. Fuller is executing this strategy through its partnership with Engent, an Atlanta-based electronics process development company. Why Engent? While many smaller EMS companies take and implement tried-and-true processes developed elsewhere, Engent develops these processes in-house. Starting as an advanced process group and eventually spinning out of Siemens in 2002 as a standalone business, Engent now has several capabilities unique for a company its size, especially in the area of leading-edge packaging, such as multichip module (MCM), chip-on-board (CoB) and MEMS.

H.B. Fuller’s hierarchy, then, includes three parts: an advanced chemistry group that focuses on developing polymer platforms and longer-term programs; a product development group focused on customer needs of today; and Engent, which will work on next-generation processes, applications development for ideas that are roughly three years out.

New Benefits, New Demands

With the new model come many benefits, but there are also demands as well. OEMs are starting to challenge the supply chain and ask what it can do to help them innovate quicker. They want partners who have knowledge that encompasses more than just what they sell and who can offer facilities that incubate the development of technology, as well as onsite production support.

Using this method, H.B. Fuller in partnership with Engent helps provide these benefits to all involved in the process. We are looking to streamline the production process upfront for OEMs and fully leverage suppliers’ and the supply chain’s intense knowledge and infrastructure. And we are approaching the supply chain in a way that focuses on solving problems at the system/design level rather than the traditional method of suppliers selling a specific material or equipment.

This model represents an efficient method for developing products and speeding innovation, and it offers benefits at every level of the supply chain. OEMs get the innovation and help from the supply chain they need to keep pace with consumer demand and will also enjoy better advancements in technology for their products in a compressed timeframe, providing a competitive advantage in one of the most highly competitive marketplaces. Suppliers achieve maximized yields and are more involved in the innovation process – being proactive instead of reactive. And the rest of the supply chain benefits from their increased access to communication lines with OEMs.

While we believe this strategy will work for H.B. Fuller, the likelihood of it becoming the standard model is small, but there are reasons for that. It is a model better suited for materials suppliers than for capital equipment manufacturers. Assemblers tend to prefer common equipment in order to avoid having to train employees and support multiple equipment sets. When it comes to materials though, most customers want choices. The materials business is not binary. Even when a supplier doesn’t “win” a program, it tends to get some of it.

Companies with both Engent’s size and technical capability are hard to find. Materials companies as a rule don’t invest in EMS capabilities, as running a service-heavy business is not necessarily a core competency. In addition, most materials suppliers invest where there’s promise of future volume. This approach is not always going to result in a new and widely used technology.

But the new model does resonate with some OEMs, as key players see a need for early stage design capability. Even if there’s no guarantee that a new, highly commercial material will be developed, H.B. Fuller’s success will be measured on whether we continually develop our knowledge base and increase the pace of innovation.

Matt Perry is the director of North America business development, electronic materials at Engent (engentatt.com); matt.perry@engentaat.com. Zhiwei Cai is director of electronic and assembly materials at H.B. Fuller (hbfuller.com).

Optimized, automated material replenishment can significantly cut solder waste.

If there’s one certainty in the print process, it’s that you have to have paste in front of the blade to print. Seems obvious, I know, but I could tell you countless tales of board defects, line stoppages and low yields because of insufficient solder paste in front of the squeegee blade. And, while it seems easy enough, in a high-volume manufacturing environment that’s producing assemblies with highly miniaturized devices, ensuring consistent volumes of paste in front of the squeegee is essential to high yields and optimized throughput.

What I’ve observed on many occasions is an operator who manually puts down a tremendous amount of solder paste so that it will last the entire shift. This approach might be sufficient in an operation that is fairly low volume and is assembling standard SMT boards. If, however, one is printing at a higher level with more miniaturized devices, more complex circuitry and geometries in high volume, having the correct quantity of paste in front of the blade is critical. Without it, print quality and, therefore, yield levels are affected.

The other factor to consider is the impact the environment is having on the solder paste. Laying down an entire jar of solder paste at the beginning of the shift may certainly lend itself to unintended consequences. With a material that is potentially changing with environmental exposure (i.e., the material may be susceptible to moisture; solvents could be pulled out by the atmosphere, etc.), the dynamics of the print can be upset. So, not only is it ideal to have the correct volume of paste in front of the blade, but the correct volume of fresh paste.

Automating paste deposition is the most effective method to ensure proper volumes of new, fresh material is placed in front of the squeegee blade. Most printing equipment manufacturers have such tools, and they are worth the investment. Automatic paste deposition technology can be combined with a paste roll height monitor for completely automated, hands-off, quality paste management. The paste roll height monitor functions just as the name implies; it uses a vertical laser to detect paste presence and roll height sensing, which saves significant operator monitoring and application time. Closed-loop paste level detection provides alerts for either manual or automatic paste replenishment and, therefore, avoids insufficient paste deposits and down-the-line defects. According to our company’s test data, combining the paste roll sensing functionality with automatic paste dispensing has numerous benefits, particularly in high-volume operations. Operator intervention is significantly reduced and can result in downtime savings of up to 40 min. per day. When your printer is churning out over 2,000 boards per day, that can result in tremendous throughput improvements.

Optimized, automated material replenishment has also been shown to reduce paste outside the print area by 80%, and solder paste wastage is significantly reduced, saving as much as 100g per day. In addition to the cost benefits from limiting paste wastage, perhaps the most significant benefits are defect reduction and process control improvements. When the volume of paste in front of the blade is inconsistent from side to side – particularly with smaller, high-density apertures – there will be defects. In fact, data from one of our customers showed that there were 685 defective parts per million (DPPM) fewer when using automatic paste replenishment. Finally, Cp and Cpk also showed substantive improvement when using the combination of paste roll height sensing and automatic paste replenishment. The Cp moved from 2.19 without these technologies to 2.57 with them, and the Cpk increased from 1.8 to 2.34 when the systems were incorporated.

At the end of the day, when variables are removed from the printing process, the better the results will be. Less operator intervention generally equates to more effective process control. Such is the case with machine-controlled paste roll height monitoring and automatic paste dispensing. The combination of these two technologies improves throughput, reduces material waste, dramatically increases yield and raises quality levels significantly. With an ROI payback of less than one year, it’s a quality investment worth making.

Clive Ashmore is global applied process engineering manager at DEK International (dek.com); cashmore@dek.com. His column appears bimonthly.

Press Releases

- Governor Glenn Youngkin Announces First-of-its-Kind American Tin Production Facility

- Surf-Tech Manufacturing Unveils 4,000 sq-ft Expansion, Growing Operations by 50%

- Cetec ERP Expands into Europe with New Strategic Partner

- Vexos Appoints New SVP of Operational Excellence; and Expands Juarez Manufacturing Capacity