7 Key Drivers of Change in Product Design Today

A study of nearly 300 companies reveals shifting approaches to hardware and software.

How are companies addressing digital transformation, ever-increasing design complexity and the effects of a post-pandemic world on tech companies amid the so-called “Great Resignation?” This year, our technology-led analyst firm, Lifecycle Insights, conducted an in-depth independent study to learn more about and better understand what the coming years hold for engineering. The survey collected responses from 274 companies that design products across all major industries, with revenues ranging from $1 million to over $5 billion.

To say the Covid-19 pandemic is having lingering effects on how companies are operating in the “new normal” of a post-pandemic world is a tremendous understatement. Technology continues to advance rapidly in a time of historic levels of digital transformation. Evolving markets for electric vehicles, IoT devices, 6G, miniaturization, and more are increasing the need for systems and product design flows and tool capabilities without pause. Digital twins, artificial intelligence (AI) and augmented reality (AR) are terms we use daily, and product and systems design flows developed to accelerate first-pass design success are continually evolving.

Lifecycle Insights’ 2022 “Digital Transformation on the Engineering Executive’s Strategic Agenda” consisted of more than 60 questions focused on several key themes. They included:

- Product development improvement efforts,

- Developments that address design complexity,

- Attitudes toward cloud-based applications and investments, and

- Improvement efforts planned to achieve product development goals.

Follows are seven key drivers of change that the survey revealed.

Driver 1: Companies are hiring – and buying software. Despite the shift to remote work over the past two years, our survey revealed 52% of companies are purchasing new software solutions to address design complexity. And, amid the Great Resignation, 57% are hiring new personnel.

To support digital transformation, companies are acquiring new computer hardware and changing their processes. Tools for both product and application management – along with personnel to develop and manage those tools – are in demand. In fact, 41% of companies reported that changes to organizational structures and roles were part of their effort to improve product development.

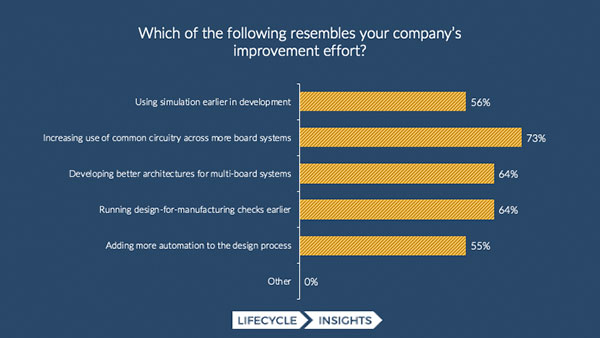

Driver 2: Simulation and MBSE. It came as no surprise that 56% of companies surveyed are using simulation earlier in development (FIGURE 1). Downstream simulation and verification, which have begun to “shift left” over the past decade, are now becoming integrated capabilities of a full-flow concurrent design platform. Improvement efforts also include a 53% movement toward a model-based systems engineering (MBSE) approach and the addition of more automation to design processes, all driven by time-to-market and pressures to lower product costs. Growth in multi board product design platforms, for example, has emerged as a clear trend. These platforms improve the entire design process by considering and automating simulation and analysis from product inception to manufacturing.

Figure 1. Technology process trends. (Source: Lifecycle Insights)

Driver 3: Cloud-based engineering applications. When asked what best describes their company’s official attitude toward cloud-based engineering applications, 63% of respondents are either already in the process of transitioning to cloud-based applications, exploring their options or planning to move to cloud-based applications. In fact, 24% stated that a vast majority of their engineering solutions already run on private or public cloud services. These companies are moving fast, with 49% targeted to be supporting cloud solutions within the next 24 months. These decisions are aimed to help their companies lower upfront costs, support remote accessibility for employees and collaborators, reduce overhead, and ease integrations with other cloud solutions.

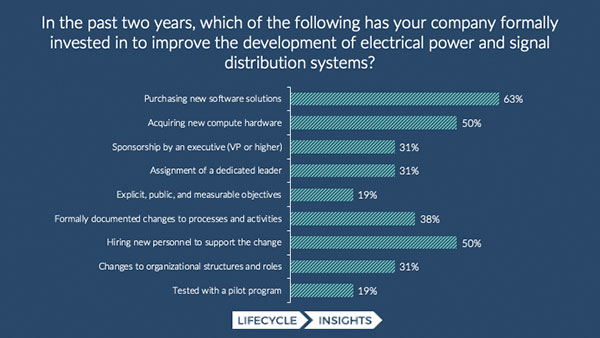

Driver 4: Increasing number of electrical endpoints. Make no mistake, the average number of electrical endpoints – that is, circuit boards, sensors, antennas, etc. – in products is increasing. In fact, 35% of our survey respondents reported seeing between 10 and 25 electrical endpoints in their products, while 45% reported that their products are seeing from 26 to more than 200 endpoints. This increase in endpoints over the past two years has impacted signal and power distribution systems, increased the number of network signals, and raised the bandwidth demand required to support communications. As a result, 80% of companies surveyed reported they have formally invested in efforts to improve the development of their electrical power and signal distribution systems.

Driver 5: Security concerns. Whether it be from apps on connected devices, desktops, or software running on cloud applications either on-premises or off, security concerns are driving companies to improve engineering processes for most companies. Software on a public cloud was of greatest concern.

That said, cloud and high-performance computing ranked as most important to companies’ future improvement efforts. Where does security stand when it comes to making purchase decisions for engineering solutions? Well, 48% reported it was a moderate or top influencer and are exploring ways to improve security based on cloud company competencies.

Figure 2. Capital investment trends. (Source: Lifecycle Insights)

Driver 6: On-premises or outsource? Although circuit boards are generally designed internally, it was interesting to learn that 20% of companies surveyed have been designing circuits on-premises for five or fewer years. In addition, we found that 33% of companies are outsourcing the systems engineering for their products.

Complexity – in terms of innovation, technology and new product introduction (NPI) – is driving companies to improve their engineering efforts. To address supply chain resilience, companies that historically outsource component selection are looking at ways to bring those services in-house so supply issues are addressed the moment they are encountered, to accelerate decision-making. Although the top barriers to achieving improvement benefits were lack of budget support and unclear objectives or metrics, 52% of companies surveyed stated they have achieved benefits from their improvement efforts.

Driver 7: Design improvement efforts. In addition to simulation, more than half the companies surveyed revealed they are also investing in processes that improve and accelerate design. Those efforts include increasing design reuse circuitry, developing better architectures for multi board systems, implementing earlier design for manufacturability (DfM) checks and adding more automation to their design processes. In addition, companies are focusing more intensely on product lifecycle management (PLM) and application lifecycle management (ALM) to ensure products are being developed and designed with regulatory and compliance requirements in mind. From adopting agile principles to best practices, companies are investing in platforms that help their teams manage requirements through systems development processes to reduce design cycle time and improve quality.

These seven drivers provide key insights into the ways that company executives have pursued efforts to address growing design complexity and the impacts of remote work. The study showed a strong correlation between timely investments in digital transformation and measurable improvements in performance. That said, from year to year, the initiatives that delivered benefits over the past two years are not guaranteed to deliver again over the next two. •

is a senior industry analyst for Lifecycle Insights (lifecycleinsights.com), with more than 30 years of expertise in electronics, ECAD design and the EDA industry, where he is dedicated to research that helps executives realize value from tech-led initiatives without disruption; john.mcmillan@lifecycleinsights.com.

Press Releases

- Kurtz Ersa Goes Semiconductor: Expanding Competence in Microelectronics & Advanced Packaging

- ECIA’s February and Q1 Industry Pulse Surveys Show Positive Sales Confidence Dominating Every Sector of the Electronic Components Industry

- Hon Hai Technology Group (Foxconn) Commits To New 5-Year Sustainability Roadmap Through 2030

- Amtech Electrocircuits Navigates Supreme Court Tariff Ruling