What’s the Deal with the Altium Deal?

The masses are atwitter over the recently announced Renesas acquisition of Altium, and for good reason. The $5.9 billion price tag is some real coin.

The masses are atwitter over the recently announced Renesas acquisition of Altium, and for good reason. The $5.9 billion price tag is some real coin.

What’s less clear to almost everyone outside the two companies, however, is the underlying strategy and how the merged entity will look going forward.

In announcing the acquisition, Renesas chief executive Hidetoshi Shibata called it “an important first step into our long-term future.” But what is that future?

Obviously, Renesas is not going to take Altium private, for exclusive use by its own customers. The two firms do have many overlapping markets: IoT, consumer, automotive, among others. Renesas also plays in higher-end areas such as high-performance computing that Altium has not to our knowledge penetrated. If OEMs want one-stop shopping for a systems program, a combined Renesas-Altium starts to make some sense. But the latter lacks the chip package tool to complete the proverbial – and literal – circuit.

Renesas does plan to open Altium’s signature 365 platform to “enable integration with third-party vendors across the ecosystem to execute all electronic design steps seamlessly on the cloud.” This permeates the Apple-like shield Altium had in place that restricted outside developers from offering tools that could bolt-on to Altium 365 in ways that enhanced the user experience, perhaps even more efficiently than Altium could do itself.

Less clear, however, is why Altium is worth so much to Renesas. Yes, it likely has as large an installed base as any major PCB CAD company. Its revenue, however, puts it behind Zuken in fourth overall, well behind Cadence and Siemens. Shibata highlighted Altium’s growth rates and profitability. But neither its revenue nor its net income ($43 million in its last fiscal year) will move the needle for Renesas.

As for the price: Renesas will pay $5.9 billion in the all-cash transaction. That’s a healthy premium relative to other significant deals in the industry over the past decade. I’m not of the mindset that every deal must pay off in direct financial ways, but given the price tag, on the surface I think this one will be a tough climb. Extrapolating Altium’s net income, it would take 137 years to recoup the investment, and that’s not counting the time value of money and so forth.

That said, big deals are nothing new to Renesas. Including the pending Altium check, it has spent some $22 billion on various chip and software companies over the past seven years.

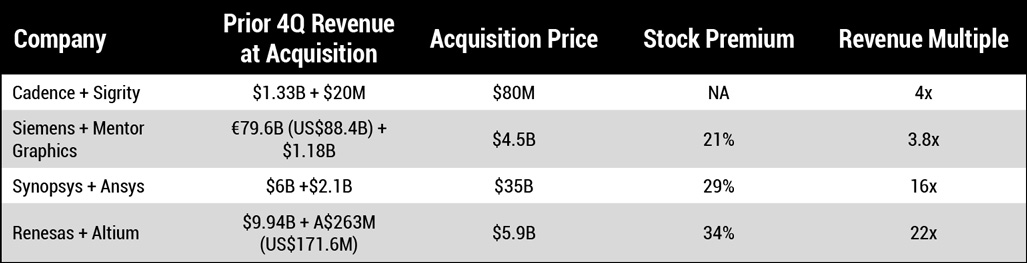

How does this one rank with other high-profile ECAD M&As? Let’s look at some measures:

Cadence bought Sigrity in 2012 for what now seems like couch change: $80 million.

The Ansys acquisition announced last month reportedly will increase Synopsys’ total addressable market by 50% to $28 billion. While Synopsys is strictly EDA, Ansys plays heavily in the automation space, with focus on large end-markets like automotive, aerospace and industrial. Semi makes up less than one-third of Ansys’ revenue. (Asked on a conference call how the Altium deal would affect Renesas’ TAM, the company demurred.)

Going back even further, Mentor paid $19 million – that’s an “m” – to nab VeriBest and its autorouting technology from Intergraph in late 1999. That was less than one times revenue.

This all can be traced back to Siemens’ 2017 acquisition of Mentor Graphics. Under duress after multiple hostile takeover attempts, including one by Cadence, Mentor was acquired by the German conglomerate at less than four times annual revenue. Synopsys is paying 16 times revenue for Altium; Renesas is paying more than 22 times revenue for Altium. How the CAD company’s former shareholders must be wishing they were still on the block now!

Renesas hinted that Altium shouldn’t be viewed in a vacuum but as part of a larger strategy. Will Zuken be next? At $250 million in revenues over the past four quarters, and a market cap of $630 million, it would likely be a far cheaper buy. And Zuken could add chip package and high-end PCB tools to the suite, while also bringing several major military and aerospace customers. Zuken has danced with others through the years. Might it someday find a new home with Renesas?

A ‘smart’ deal? Speaking of deals, the spotlight is on the synergy between the world’s largest physical retailer and a Top 10 maker of smart TVs. Walmart, which already sells Vizio’s smart flatscreens by the boatload, is expected to benefit by expanding its ad-targeting capabilities to connected television, per Axios and other analysts.

But I find it intriguing for other reasons: It is an audacious revamping of the OEM-distributor relationship.

Walmart is in fact the world’s largest retailer, with annual revenues topping $635 billion. That’s well above that of Amazon ($350 billion range in retail; much larger if services are included). The margin grows if we subtract the billions in revenue Bezos and Co. collect selling their internally sourced brands, such as Eero routers, Kindle e-readers, Fire tablets and TVs, and of course Alexa and Echo smart home devices. And that’s just the electronics side of its vast private label businesses.

Walmart, of course, has its own private labels as well, but they tend to be in the home and sporting goods and automotive spaces. Electronics was an afterthought.

Vizio, however, adds a $1.7 billion electronics arm, complete with all the requisite supply chain demands, from design to parts procurement to manufacturing to logistics. How will this affect Vizio’s sourcing strategy? Will Walmart overlay its procurement approach? Will Vizio’s competitors attempt to undercut their tie-up with Walmart by asserting that the new owners will give their own channels precious advantages on retail walls and shelves?

I’m not discounting the already robust Vizio supply chain practices, but there’s a learning curve both organizations are about to experience: Vizio with a new corporate overlord, Walmart with an outside team whose operational methods are almost certainly different than its own. Who will bend, and how?

P.S. Our condolences to the family of Tony Hilvers, a former executive at IPC who was the EMS industry’s biggest cheerleader in the 1990s and 2000s, who passed away in January. Tony was instrumental in recruiting me to IPC in the 1990s, and he was a strong advocate for the recognition of EMS as a standalone industry in the media and the stock markets.

is president of PCEA (pcea.net); mike@pcea.net.

Press Releases

- Beyond Torque: New Seika Machinery Webinar Reveals How Strain Gage Technology Exposes Hidden Bolt Axial Force Risks in Battery and PCB Assemblies

- New SASinno Ultra-i1 Gives K&F Electronics Added Flexibility in Selective Soldering

- Smartsol and Koh Young Technology Announce Strategic Partnership for the Mexican Market

- RBB Systems Boosts Manufacturing Capabilities with Equipment Upgrades for 2026