ITRI Survey Shows Continued Growth in Tin Use

LONDON -- ITRI's 13th annual survey of tin users shows growth of 3.3% in 2016.

The trade group gathered data between June and August 2017 from tin users worldwide, representing 136 companies and some 46% of estimated global refined tin use.

TRI also expects continued though more modest growth in 2017. "Latest reports for the latter half of 2017 suggest tin usage in chemicals and tinplate in China has been stronger than the 1.3% indicated by our survey results," ITRI analyst Tom Mulqueen said. "If this is sustained then it is possible we could see global refined tin consumption growth of around 2% in 2017."

Key headline findings from this report include:

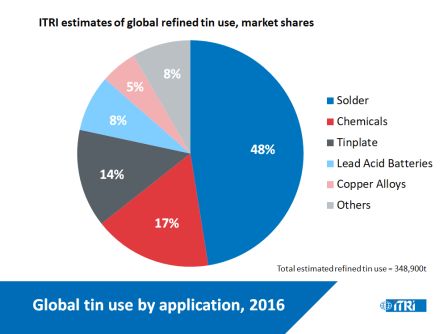

• ITRI's latest estimate of refined tin use in 2016 is 348,900 t, based on data from the 2017 survey. The figure is just 1,200 t lower than the preliminary 2016 estimate made following last year's survey. Refined tin demand reported by survey participants increased by 3.3% in 2016 with more modest growth anticipated in 2017.

• Solder still accounts for the largest global share of tin use, recovering into growth from a long-term low in 2015. China powder and paste producers were particularly positive. The automotive sector is likely to be a key driver, as well as new markets such as solar solders, although miniaturisation is still a threat and many respondents expected future solder sales to be static or in decline.

• Tin use in chemicals grew by 5.5% in 2016 and is expected to increase outside China in 2017. The sector in China was temporarily impacted this year by government environmental inspections. Tin price and competition are still significant issues but threats from regulation may have receded as PVC and other polymer markets have grown strongly. Traditional markets for inorganic products remain static or in decline.

• Tinplate use continues to remain static or in decline, although some growth is projected outside China for 2017. China production is still challenged by industry issues including poor profitability, with higher tin prices and impending national regulation on quality. Alternative packaging is gaining ground in China and there is some concern over new tinplate passivation grades.

• Tin use in lead-acid batteries continued to grow strongly as use markets in automotive, motive, telecoms and now utility grid storage expand. The trend towards higher performance products such as new stop-start hybrid vehicles will benefit tin in the medium-term, although threats from lithium-ion batteries are already apparent and the important China e-bikes market will decline sharply.

• Provisional estimates of total global tin use including refined and unrefined forms totalled 422,900 tonnes in 2016, up 1.7% from 2015. The Recycling Input Rate (RIR) was calculated as 30.7% in 2016, down from 31.4% in 2015.

• Pipeline refined tin stocks held by surveyed companies at the end 2016 amounted to the equivalent of 3.39 weeks' supply. If this ratio is extrapolated based on global consumption it would imply that world consumer stock holdings were around 23,000 tonnes.