Will IC Package Substrate Makers be Next to Rule?

Massive investment suggests the segment could occupy a major portion of the largest fabricators' production.

The heartbreak of the pandemic of 2020-21 is receding, but printed circuit fabricators continued to feel the supply-chain reverberations throughout the past year. The rollercoaster gyrated from a sharp dip to an intense high, with demand for consumer electronics, autos and other electronics resulting in tight inventories and long lead times. Then came the inevitable slowdown. Regionalization, currency swings and price cuts played havoc with manufacturers' order books and financials.

That's the picture drawn by this, the 26th NTI-100 report. As in the past several years, a rough conclusion is "big gets bigger and faster." Due to exchange rates that were favorable to the US dollar in 2022, the author thought there would be changes in the rankings, but they remained approximately the same as in 2021. Japanese fabricators were a surprise. Despite a 20% loss in value against the US dollar, their world ranking remained almost the same as in 2021. Domestic customers wanted to get PCBs from within the country because of supply-chain disruptions in China, resulting in good order intake.

As in the past, the author would like to thank various trade organizations and many firms and friends who provided vital information that enabled the compiling of this report. Any errors in this report are the responsibility of the author.

Currency Swings

Currency fluctuation in 2022 was wild, as seen in TABLE 1. Five currencies dropped more than 10% in value against the US dollar. The Japanese yen lost 20% of its value. At the time of this writing, the exchange rate was ¥146/$1. Taking advantage of this lowered value of yen, the number of foreign tourists flocking to Japan is larger than the peak prior to the Covid pandemic.

Table 1. Average Exhange Rates (local currency/US dollar)

The author started the NTI-100 study 26 years ago to understand world PCB production. The NTI-100 list is a byproduct of this study. Included are fabricators that produced at least $100 million in revenue in 2022. There are many mergers and acquisitions around the world, and it is hard to track them all, yet doing so is critical to compile the list. The most difficult region is China. To the Chinese they may not be so complicated, but to this author many fabricators in China are elusive when it comes to financial reporting. Educated guesses were necessary, and the need for educated guesses is becoming a source of errors. The rankings are relative. Don't take them so seriously.

The $100M Club

This year's NTI-100 report segments the rankings in groups of 25 (TABLE 2). Under careful examination, you can understand the trend of "big gets bigger and faster."

Table 2A. Largest PCB Fabricators in 2022, 1-25

Table 2B. Largest PCB Fabricators in 2022 , 26-50

Table 2C. Largest PCB Fabricators in 2022, 51-75

Table 2D. Largest PCB Fabricators in 2022, 76-100

Table 2E. Largest PCB Fabricators in 2022, 101-125

Table 2F. Largest PCB Fabricators in 2022, 126-139

IC package (IC PKG) substrate fabricators did well in 2022, except for Ibiden and Shinko Electric, whose fates depend heavily on Intel, which did poorly in the second half of 2022 due to poor PC sales. In the first half of 2023, the semiconductor business was still poor. July brought signs of recovery, but the revenue increase is lukewarm. It is expected, however, that the semiconductor business will heat up in 2024 and 2025. That's good news for IC PGK substrate fabricators. In 2022, the IC PKG substrate sector of PCB production amounted to slightly more than 20% of total PCB production in value.

Automotive PCB fabricators also enjoyed good business in 2022 because of strong EV shipments. Price competition is said to have been almost "ugly" in China, however. Newcomers to this sector dropped prices to capture market share, which dragged down profits among traditional automotive PCB fabricators.

Strong sales of PCs, tablets, smartphones, etc., induced by remote work and study in 2020-21 due to the pandemic created mini booms for these products. The boom ended in 2022. As a result, motherboard fabricators for these products suffered.

Several fabricators "disappeared" from 2021 to 2022. Compare the lists of those two years: Some lost revenue in local currencies, and some did so because of currency exchange rates.

The top 21 Japanese fabricators are shown in TABLE 3. Ceramic circuits are not considered in these tables.

Table 3. Largest Japanese PCB Fabricators (≥$100m), 2022

Brief Analysis

Nine fabricators produced more than $2 billion in output in 2022 and 25 others had revenues greater than $1 billion, three more than in 2021. This is despite the loss in value of all countries' currencies against the US dollar.

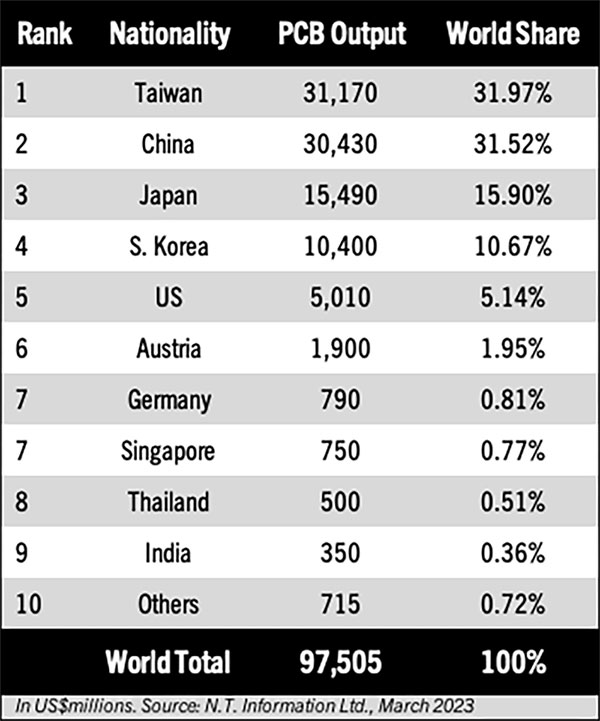

Taiwan's output of $30.3 billion by fabricators on the list and China's $26.1 billion account for 65% of the total of the 139 fabricators on the NTI-100 in 2022. In the 1980s, the combined output of these two countries was infinitesimal. They will continue to increase their world share when their continuous investment is considered, a major portion of which is in Thailand. In fact, all top Taiwanese PCB fabricators are building new plants in Thailand, although a few are investing in Malaysia and Vietnam.

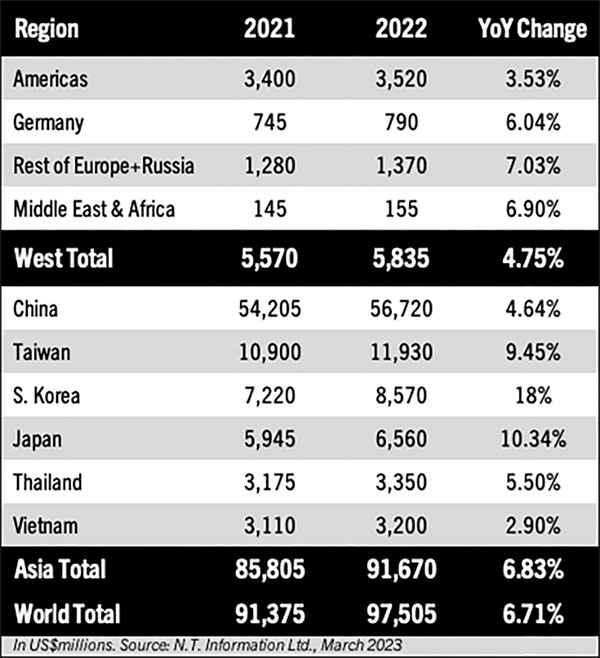

Every region saw local production grow in 2022 (TABLE 4), while Taiwanese fabricators produced the largest value of PCBs in all its companies' factories worldwide. (TABLE 5)

Table 4. Estimated PCB Output by Region, in 2022 Exchange Rates

Table 5. Estimated World PCB Ouput by Nationality, 2022

Zhen Ding Tech produced 6% of the world production. Its chairman claimed that ZDT aims to produce 10% of the world PCB production by 2030.

Zhen Ding Technology or ZDT for short (瑧鼎科技) is listed on the Taiwan Stock Exchange (TSE). Its consolidated revenue is reported here. ZDT is also listed at Shenzhen Stock Exchange under the name Avary Holdings (鵬鼎控股). Avary Holdings reports revenue from China only and it does not include its IC PKG substrate subsidiary, Leading Tech (礼鼎半導体). Its website is leadingics.com/cn. Leading Tech is stock listed separately, and had revenue of $180 million (all from IC PKG substrates). ZDT has another subsidiary, Boardtek in Taiwan, which ZDT purchased several years ago. Boardtek specializes in high-frequency PCBs and is one of the leaders in automotive PCB for radars.

LG Innotek experienced a revenue loss. The author does not know why.

The aggregate output of the top 139 fabricators was $87 billion in 2022 (TABLE 6). The author estimates that the remaining 2,400 fabricators worldwide produced about $10 billion.

Table 6. NTI-100 Distribution by No. of Entries and Revenue, 2022

Based on the above, the total output in 2022 is estimated to be about $97 billion. Some $9 billion of the total came from assembly operations by PCB fabricators, making the total "bare board" output in 2022 $89 billion, of which $17.7 billion came from IC PKG substrates. In other words, IC PKG substrates held about a 20% share of the total PCB output in 2022.

IC PKG substrate fabricators are investing about $30 billion in the next several years. When these investments start producing substrates, it is conceivable that up to 25% of the total PCB output may come from IC PKG substrates in the future.

TABLE 7 shows the IC PKG substrate production in 2022. Japan's output appears small because the conversion from the yen to the dollar was made using an exchange rate of ¥131.43/$1. If the average 2021 exchange rate is used, the $4.1 billion would have been $5.02 billion. To compare the output of various countries, it is necessary to use a common currency. Traditionally, such comparisons are made using the dollar, which distorts the picture, unfortunately.

Table 7. IC PKG Substrate Production, 2022

TABLE 8 shows the author's forecast of IC PKG substrate output using 2022 exchange rate. If the currency exchange rates return to 2021 levels, the $22 billion forecast for 2025 could be $25 billion. The author often wonders what sort of exchange rates the world forecasters are using.

Table 8. IC Substrate Production Forecast

is president of N.T. Information; nakanti@yahoo.com. He is the world's foremost authority on the printed circuit board market worldwide.

Press Releases

- AIM Solder Hires Francisco Rodriguez as Regional Sales Manager for Northeast Mexico

- The Test Connection, Inc. Adds Creative Electron Prime TruVision™ X-ray and CT System for Deeper Failure Analysis

- Kurtz Ersa Goes Semiconductor: Expanding Competence in Microelectronics & Advanced Packaging

- ECIA’s February and Q1 Industry Pulse Surveys Show Positive Sales Confidence Dominating Every Sector of the Electronic Components Industry