How APCT Came to Have 'A Solution for Anybody in North America'

Following its acquisition of ACI, APCT head Steve Robinson is bullish on what's ahead.

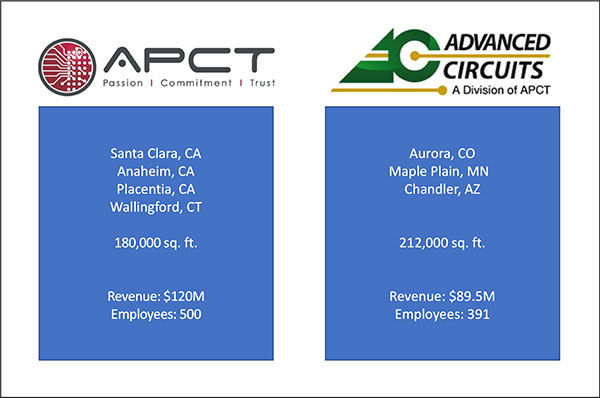

APCT in February completed the acquisition of Advanced Circuits Inc. (ACI), a printed circuit board fabricator based in Aurora, CO, and with facilities in Chandler, AZ, and Maple Grove, MN. The acquisition nearly doubles APCT's annual revenue to $200 million, and makes the company the third largest among PCB fabricators in North America behind TTM and Summit Interconnect.

In March, Steve Robinson, president and CEO of APCT, joined PCEA president Mike Buetow on the PCB Chat podcast to discuss the acquisition, the pending integration, and APCT's new responsibilities as one of the largest North American PCB fabricators. This transcript has been lightly edited for grammar and context.

Mike Buetow: Steve, regarding the acquisition, why was it the right move at this time?

Steve Robinson: We've been working with the Yacoubs [the directors of Advanced Circuits] and the ACI acquisition for about six to seven months. We started to sense a need for APCT to expand beyond our specialty offerings. We have established a business on the more advanced-technology platform. Speed and technology are what we founded APCT on and as we started to saturate that market and really grow with it, our customers started reaching out for us for more capacity and a better solution in the two-to-10-layer technology, what we consider very low technology.

APCT president and CEO Steve Robinson was interested in acquiring ACI for years.

That, along with what we saw, was very intriguing: [ACI's] software, their integration model, their online and Internet-based business were intriguing and something that I had interest in for many, many years. Customer demand, a capability and a capacity expansion of APCT that we just didn't have. When you go into the advanced technology, really HDI-focused arena, which APCT is in, there's a very large expense infrastructure, engineering and capital expense associated. Having a more-economic solution in that lower technology space was a challenge for us, and this vehicle provided us additional, very specific capacity in the two-to-10-layer technology space that our customers were asking us for. In fact, we saw an increase in demand in the industry in general and we really felt the timing was right to do this. Along with that, in the Aurora facility, we added that capacity, but in the Chandler and Maple Grove plants we also added full-blown government certifications in all classifications and some very specialty and niche capacity to support our country and our government, which APCT has been committed to for years.

The timing was good. Obviously, the geopolitical storm and the China-Taiwan situation has [sparked] a lot of chatter about onshoring and some opportunities for North America to see an increase in demand, and that increase in demand is going to be cost-sensitive. For us to add capacity in some regions that allow us to be in a more competitive platform really made sense, and my equity partners were very supportive. We launched the attempt to acquire ACI about six months ago, and like you said, closed in February. We're very excited about it.

MB: As we as we go into this conversation about the integration plan, I think you've already now addressed clearly that you have all intents to keep the ACI facilities open.

SR: We have. There is no consolidation or any type of activity. In fact, we're allowing and letting all the ACI facilities to continue to operate as ACI facilities. We're making it very easy for our customers; no challenges whatsoever. The ACI facilities will remain and will become subsidiaries of APCT Holdings. The real focus is creating that additional value. The secret for our success has been providing solutions to our customers: [We] map the trends in the direction of the industry and invest early, not chase technology, invest early in leading technology, which we've accomplished. That's how we were able to grow APCT from my original acquisition in 2008 from $4 million to $130 million last year, and this year the combined companies together will do in the $240 million to $250 million range. A significant step-up in capacity and a significant step-up in revenue and obviously a significant step-up in product offering service. We basically have a solution for anybody now in North America in any aspect of technology. From the acquisition, there's no changes. All the management, the leadership, is remaining intact. The sites will remain intact. We plan to just take advantage of the new footprint and integrate them in the APCT way and launch some really exciting solutions for our customers and the industry in general.

MB: I remember your Data Circuit days; Data Circuit was the first shop in the US I knew of that could do a 24-hour turn. Advanced Circuits is in many ways a unique operation. As you alluded to, it has a specific way of gang-building boards. They have their own design software and tools. It has a truly enormous new customer rate. They told me a few years ago that they aim for something on the order of 2,000 new customers a month. I kept asking: "Are you sure about that? You mean a year?" And they said, "No, a month."

SR: It's very active. You're right, and that's that niche specialty nest – we call it the nesting software – and the automation they have really supports the online and the Aurora facility only. That is the only facility focused on that niche and it's very exciting for us. This was my third go-around reviewing an acquisition of this company. I started back in the early days when I was running Merix globally, after they acquired Data Circuit. We danced with them a little bit back then, so this is something that's always intrigued me. That aspect of the business in Aurora is very unique, very special and niche, a lot of it online and a lot of it very customer-interactive and it's a really cool model. We're excited to expand on that and take some of that intelligence and integrate it into some of our other facilities as it makes sense.

The deal to acquire Advanced Circuits adds much-needed capacity for two-to-10-layer boards.

MB: Would you anticipate that that operations model will be adopted into some of the other facilities or will that stay dedicated to Aurora?

SR: It will stay dedicated to Aurora, but as we exceed the capacity that facility has – we will be open to launching it at a second site. We have seven facilities now in the US, and one currently supports that model only. But my CTO and my COO both are driving, looking at additional facility to launch rev 2 of that, which would be a backup and additional capacity as we see that demand grow. Everything we're hearing, from IPC reports, from industry reports, is a fairly significant growth potential for North America and demand. Should the geopolitical concerns ever come to reality – which we all hope they won't, but if they should – the chatter out there about North America, with continued EMS support and Mexico and those regions as well, we're well-positioned now to be a solution for our customers should that unfortunate event take place. That's really the strategy. Aurora will be our primary focus now on that, but we will evaluate and look, and as the demand exceeds capacity there, we will look at another site if it makes sense.

MB: You mentioned the need for more capacity, but were there any particular technology or innovations that ACI brings to the table that you don't currently have inside APCT that made it the deal attractive?

SR: Yes, absolutely. The Internet and the online model and the software specialty and the niche capabilities of the Aurora plant were very exciting for us and we wanted that. But also, the Chandler facility. Of our $120 million spend, we already have a very significant $50 million to $60 million defense and aerospace or government spend in APCT. That facility gives us a lot more capacity, to continue to grow and support that demand we're seeing. We're seeing a lot of activity and a lot of demand growth in that as well. The Maple Grove facility, which is a very specialty-focused facility, offers oversize, large form-factor panels, unique programs that are individual and specific for that site only. That's obviously a huge attraction for us as well as we'll open up into special oversized RF and rigid technology. In our space we have a ton of customers now, and it's really about merging the two sets of customers.

You're right: [ACI] wasn't exaggerating the numbers. My IT and software staff were staggered at the 8,000 active accounts we have our database. We thought APCT was rich with 1,100, but we just finished integrating that 8,000 active – not active every day – but 8,000 active accounts worldwide into our database, which is exciting for us.

APCT specializes in advanced HDI flex and rigid-flex. Those customers never had that offering through ACI. There's a handoff both ways. We're adding the advanced technology, flex, and rigid-flex capabilities into the ACI customer base. For our APCT customer base, we're excited about the specialty capabilities and oversize and special RF capabilities we now offer out of our Maple Grove facility, and the quickturn, low-tech, competitive solution that we now can offer from our Aurora operations.

The combined company has annual revenues of more than $200 million and nearly 400,000 sq. ft. of capacity across seven sites.

MB: Are the ACI software tools flexible enough and scalable so that they could be adapted to the higher tech that APCT offers?

SR: Potentially. It's early, Mike, as you know, we're two weeks into really getting under the covers now finally and really see that, and my IT team is working now with the developers and the scriptwriters. Ultimately, yes, we would look to take some of that automation up the technology curve. That's really where we see the advantage and the interaction with our customers. The more automation we can develop and software that we can introduce to make it more efficient up the curve, yes, but right now it's really focused on the two-to-eight-layer technology range, a very limited menu, and that's how it works. We'll look to expand that as it makes sense in the future.

Short term, to be honest with the acquisition right now, in 2023, no changes. I'm not a believer in coming in and making changes. We're going to spend 2023 getting familiar, getting to know everybody, getting the ACI people to understand the APCT ways and APCT to understand the ACI ways, and then 2024 will be the year where we'll start to look at making some adjustments or tweaks to the models as it makes sense, and that will come from the industry direction and customer feedback. What are they looking for? What they need? I've always based my business decisions on value to customers, whether they want, what do they need? What are they lacking? What's what we'll focus on: understanding the industry, understanding the technology, understanding the demand and trying to provide a solution that differentiates us.

MB: This type of investment, this size, this implies a certain confidence in the future of the North American market, wouldn't you agree?

SR: Yeah, I do. You know, I'm a PCB rat. My junior year in high school, 1971, was my first year working as the graveyard electroless operator. That's when I fell in love with this industry. My mentor and my early [coworkers] who trained me taught me a great respect for this industry. I've always been a big advocate of the PCB industry and focused on understanding the direction and trying to be out in front and not chasing it. So yes, I think, in all our analysis, we believe there is opportunity and that the North America industry has a chance for some decent growth, and I think we're going to be in the leading position to take advantage of that. Our speed and technology and capacity really allows us to offer a nice solution to just about any aspect of need and demand from our customers and that's important, not only my dedication to our country, our dedication to this industry, but most important, our dedication to our customers. They've been loyal and stuck with me since I started this business in 2008 and this acquisition was really focused to provide more value to them, and to provide a better menu of solutions that we were hearing they wanted and needed. That's what we've done, and my investment partners have been very supportive and are very excited about this. They stepped up and we got the deal done.

MB: Do you feel there are a different set of responsibilities that come with your [larger] market position?

SR: Yes, I think there is. We take it very seriously, with that position, to go out and try to attract and hire some young talent and bring some new blood into our industry. I don't know if there's many of "me" left who have five decades committed to this industry. We continue to look at programs, and attracting and hiring young talent; hopefully someday we'll get some support in doing that. But absolutely, I think it's important to represent our industry and provide value to our customers, to listen and understand that, and then to mentor as many as we can and that that's what APCT has always based our core competence on trying to do that, and now we have the ability to do that to a little larger scale. We're no. 2 in size and PCB product, but we're by far no. 1 in value and offerings and capabilities. We stay committed to quickturn. We stay committed to nimble. We will continue to support customers – they don't have to be big. All customers are important and that's our commitment to this industry.

And secondly, we have a huge commitment to our government and our country. Our country and our government need to be educated on how to build printed circuit boards and how to support new and emerging technologies the right way. Our engineering and design support all the way through fab is commit, but we will continue to fortify and invest in as necessary and continue to hopefully drive success, a competitive landscape, and drive North America PCB success and growth. That's the model. That's the role you play as an industry leader. And while we're not as big as no. 1 [TTM], they're huge; we are absolutely the industry leader in speed, technology, engineering, customer value, customer satisfaction, and customer support. We base our long-term relationships on customer trust, and we expect to earn that and do whatever it takes to sustain that. That's how we differentiate ourselves.

Let's do everything we can to fortify the North America PCB industry. Let's do some things to make it more attractive to attract young, smart talent and get some youth and younger generations interested to work again. Hopefully, we'll start to see a workforce that's willing to work again. That's been a challenge through the pandemic and through all the challenges we've had in our country for the last few years. Hopefully we'll see that eager workforce ready to go out and touch things and build things again. That's we're excited about. But I'm really excited about this. I think our customers are going to be very happy with the value and the solutions we now can provide beyond the many that we provided before. And I'm looking forward to a very exciting 2023 and beyond.

is president of PCEA (pcea.net); mike@pcea.net. To listen to the podcast, visit https://upmg.podbean.com/e/pcb-chat-110-steve-robinson-of-apct/.

PCB East, the electronics industry trade show for the East Coast! Coming May 9-12, 2023