Current Issue

A Two-Team Race?

For the world’s top PCB manufacturers, Apple and Samsung can make (or break) you.

For those who believe nothing changes in printed circuits, think back just 16 years to the first edition of the NTI-100. The biggest names in PCB manufacturing included Photocircuits, Lucent and Hadco, among others. TTM was just being incorporated. The US and Japan were battling for worldwide bare board supremacy. Taiwan was a relative newcomer, China an after-thought.

Every year brings changes, even if the overlying trend remains the same.

2013 was no exception. Many changes took place, particularly among Japanese PCB manufacturers. Domestic production value plunged 15% in 2013 from the previous year. One reason: The average exchange rate in 2013 was 100 yen/USD, while it was 80 yen/USD in 2010-2012, a 15% depreciation. As a result, several Japanese makers dropped off the list, as the minimum revenue to be ranked is $100 million.

There were mergers and acquisitions during the course of 2013, such as Kyocera acquiring Toppan-NEC Circuit Solutions (the new name is Kyocera Circuit Solutions, or Kyocera CS for short) and ISU-Petasys acquiring Trendtronics in Hunan Province, and changing its name to TTL. Although the total revenue by top makers increased in 2013, the number of entries on the list decreased. As usual, any errors that may exist are strictly the responsibility of the author.

Data collection. There are close to 2,800 PCB manufacturers worldwide, though this number seems to be changing (read: decreasing) almost daily. Of those 2,800, approximately 640 fabricators worldwide were examined, from which those with revenues equal to or greater than $100 million were identified. Most large Taiwan makers are publicly traded and publish “consolidated” revenues every month. Revenues of some rigid PCB makers include sales of assembled boards. In such cases, the assembly portion (PCBA) was eliminated as much as possible, although it may be possible that in some instances not completely. Some listed manufacturers are part of other stock-listed manufacturers, yet separately listed, which made it challenging to avoid double counts.

Most large flexible circuit board (FPC) makers are engaged in assembly operations (FPCA), and their reports include mixed revenues, bare board and assembly (cost of assembly and components). Their bare board portion ranges from 40 to 80% typically, depending on their customer mix. It is not possible to separate the bare board portion accurately when considering FPC makers, and therefore, in those cases no attempt was made to eliminate assembly value. If an attempt is made to “guess” the bare board portion, gross errors are likely to occur. Hence, strictly speaking, the ranking table presented in this report does not reflect a fair comparison, but this cannot be helped. Judgment is left to the readers.

The revenues of most publicly traded manufacturers are easily identified. However, some listed makers do not identify the PCB portions clearly. Sumitomo Denko, Hitachi Chemical, Multek, Sanmina, 3M and several others, which belong to large corporations, do not break out PCB revenues. The author’s private communications with those companies helped determine reasonably accurate numbers. In the case of 3M, its revenue is a pure guess, as every year.

The author would like to express his gratitude to those makers that shared revenue data and also to two trade organizations, TPCA and CPCA, for their valuable assistance.

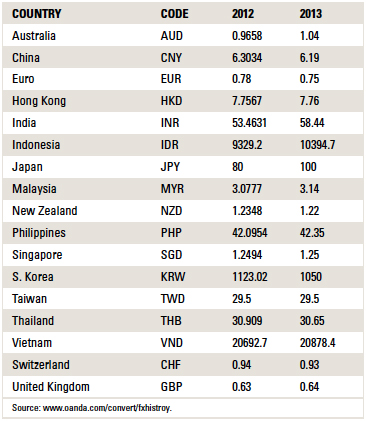

Exchange rates. Readers are reminded that slight variations of exchange rates sometimes make big differences in ranking. Some Chinese makers presented their revenues to the author in US dollars without disclosing the exchange rate used. It turned out that each one used slightly different exchange rates; the converted revenues were adjusted according to the RMB/USD exchange rate shown in the table. Some revenue reports included the 17% VAT, which had to be eliminated.

In order to baseline growth rates, 2012 revenues were adjusted to 2013 exchange rates.

Taiwanese Stock Exchange-listed manufacturers report consolidated revenues to the TSE every month. Some manufacturers report revenues in US dollars every month in their financial columns, and at the end of each year indicate total revenue in USD, which is the sum of 12-month revenues, each month converted to USD with a “monthly” average exchange rate. The result is slightly different from 12-month revenue in NTD in local currency converted to USD using “average yearly” exchange rate. The author chose to convert yearly revenue with average yearly exchange rate.

Table 1 shows the average exchange rates used to convert revenues in local currencies to US dollars. In 2013, the yen fell 25% in value against the US dollar.

Table 1. Currency Exchange Rates

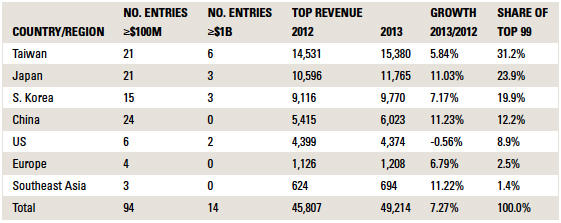

2013 trends. The NTI-100 list presents an interesting picture. Broken down by region, the list reveals many things (Table 2). The 99 PCB manufacturers with revenues greater than $100 million, for instance, accounted for 84% of the total world production of $60 billion.

Table 2. NTI-100 by Region

It is said that approximately 20% of semiconductor devices are consumed by two smartphone makers: Samsung Electronics and Apple. Since the value of a given PCB is about 20% of semiconductor usage, it may not be an exaggeration to say that these two smartphone giants consumed about 20% of the total PCB output.

Generally speaking, those PCB makers that supplied to Samsung (many Korean nationals) and Apple did well in 2013, despite the fact that average selling price (ASP) plunged tremendously. The price plunge was compensated by volume increases. However, while profits have seemed to decrease continuously the past few years, fabricators continue to increase production capacity, inviting further price erosion. This is a vicious cycle. Newcomers and those with expanded capacity tend to offer lower prices, sometimes just to cover depreciation costs. In turn, OEM customers do not have to relentlessly pressure their PCB suppliers for price concessions. Instead, the competition triggers further price erosion, particularly in technology-oriented products such as 10-layer “any-layer” products. Technology is not necessarily a guarantee for better profit. As a matter of fact, single-sided boards, considered low tech, bring better profits.

PCB makers for media tablets also did well. These fabricators typically supply boards for smartphones. Smartphones and tablets use a large number of wireless chips. Hence, IC substrate suppliers (such as Kinsus of Taiwan) to chipmakers Qualcomm and MediaTek, two leaders in wireless chips, excelled.

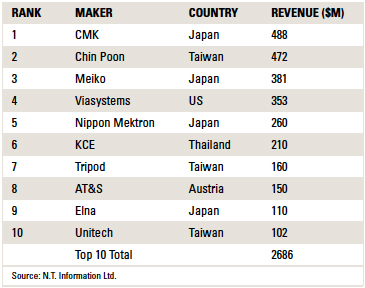

Automotive PCB is another hot area. The barrier to entry is high, but once a PCB maker is certified, fairly steady growth of 5 to 6% annually is possible. The author estimates the total automotive PCB market is close to $5 billion annually (about 8% of worldwide PCB production) and is increasing faster than the rate of automobile shipments, as more electronics are adopted for automobiles, particularly in the area of “infotainment,” for safety and driving information.

Table 3. Top 10 Automotive PCB Makers in 2013

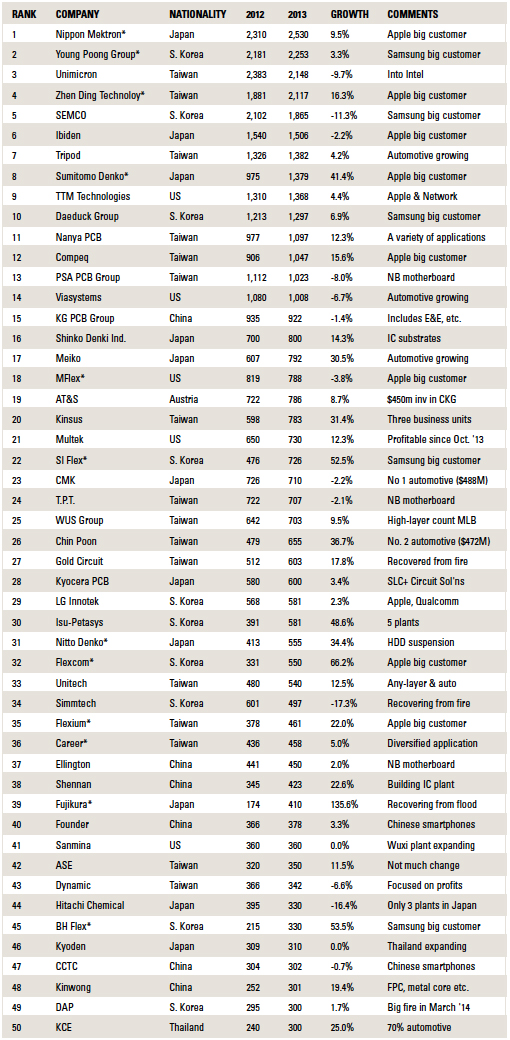

Select makers. Some PCB manufacturers may not be familiar to readers, although simple explanations are attached for each listing. It is best to explain each one in the NTI-100 Table 4, but not practical due to limited space. The choice of makers is purely random, and the selection is in descending order of revenue.

Table 4. The NTI-100 World’s Top PCB Makers in 2013 ($ millions)

It is well-known which fabricators supply to Apple and Samsung (and Continental, Bosch and Denso, etc.), although some firms forbid their suppliers to mention their association. It is rather comical to know that “Apple” is not to be mentioned in Japan among suppliers. It is referred as “B” company or “Banana” company there and as “Fruit” company in Taiwan and China. Apple and Samsung may not like to see their names on the list, but they are mentioned so readers can see why some fabricators grew or declined in 2013.

PC and TV shipments continued to decline in 2013, and hence PCB makers that supply to these two markets generally saw reduced revenue. Digital still camera (DSC) shipments have been declining 15% to 20% in the past few years, its function being taken over by smartphones. As a result, those HDI board makers that supply to this market experienced revenue decline.

At the time of this writing, suppliers of infrastructure boards in China are very busy because of the TD-CDMA 4G LTE introduction in China, which requires tens of thousands of base stations. This will change the 2014 map.

It is commonly understood that for a mature market, 80% of the revenue is in the hands of 20% of suppliers. Insofar as the PCB market is concerned, this rule does not apply. Instead, roughly 5% of the companies own 90% of the market. The big get bigger and faster.

Nippon Mektron is the No. 1 maker for the third time, and the second in a row. It is said that more than 80% of its revenue is now obtained from overseas production.

Young Poong Group consists of Interflex, Young Poong Electronics, Korea Circuit and Terranics. Interflex has a branch factory in Tianjing, China. YPG’s FPC portion was $1.7 billion in 2013, assembly included of course.

Unimicron includes Ruwel AG, Clover Electronics and Subtron. It has been building a PCB complex in Jining, Shandong Province, China, and has MOU with the city of Huang Xi, Hubei Province, where Wus is building a plant.

Zhen Ding Technology is one of the largest FPC suppliers to Apple. A strong association with Apple is natural since its parent, Foxconn, is the largest contract manufacturer of various Apple products.

SEMCO (Samsung Electro-Mechanics) is expanding HDI operations in Kunshan, China, by building a second factory.

Ibiden is pouring $400 million into its second Penang plant for HDI expansion and also expanding its Beijing plant to cope with increasing layer counts. Although Ibiden had a revenue decline, its profits improved in 2013.

Tripod has been emphasizing HDI boards and automotive PCB in recent years. Its Xiantao plant built on 870,000 sq. m has been partially operational and continues to expand.

Sumitomo Denko Printed Circuit has grown strong rapidly by supplying FPC (assembled) to Apple. It is rumored that half of its revenue comes from Apple contracts. Its overseas production now far exceeds domestic volume.

TTM Technologies sold shares in Shengyi Electronics and bought back shares of Shengyi Electronics at its Dongguang Meadville Circuits. Its Shanghai Meadville Technology-Silicon Platform plant (seven stories) is being equipped and will commence operation. Although the former Meadville Technology is now called TTM Asia Pacific, individual plants seem to retain the original names, which is normal in China, due to the complexity of changing “Chinese” names.

Daeduck Group underwent major organizational changes early this year. Its IC substrate subsidiary, APERIO, is now a part of Daeduck Electronics. HDI, FPC and rigid-flex circuit (RFC) operations are now placed under Daeduck GDS.

Nanya PCB recovered from its loss of Intel business. Although IC substrate is the largest product line of Nanya PCB, it has been expanding into the automotive arena as well in recent years.

Compeq Manufacturing has been growing steadily the past several years. In 2013, its revenue exceeded $1 billion. (Congratulations! You are now a member of the NTI $1 Billion Club.) The company supplies boards for the iPad, iPod, iMac and iPhone. It is also strong in the IT business. Phase 1 of a new plant in Chongqing is ready to commence production at any time. It also operates an assembly business in Suzhou.

PSA PCB Group consists of HannStar Board and GBM PCB operations. (“PSA” stands for Passive System Alliance.) HannStar PCB seems to have given up the intended Chongqing plant. Instead, its sister company, GBM, built a plant in Chongqing (80% NB motherboards) and plans to build a second one. The plant site has a land area of 1.2 million sq. m! Through GBM, the group has PCBA operations worth more than $700 million.

Viasystems Group is the second-largest military PCB supplier, after TTM. It completed construction of the second, six-story manufacturing building at its Zhongshan campus. The site is the world’s largest plant dedicated to automotive PCB. It has recovered from the fire last year at its Guangzhou plant. Its Anaheim plant was moved to the newly renovated plant under a single roof (previously owned by MFlex), less than a mile away from the former DDi campus, one of the few new PCB manufacturing plants built in the US in recent years. Its Oregon facility was renovated last year to concentrate on high-tech products.

KG PCB Group consists of Elec & Eltek, Techwise, Jiangmen Glory Faith, Top Faith, Evertek and Express Circuits. There seem to be a few other PCB makers under Kingboard Chemicals in which KG has minority shares. The revenues of these are not included in its consolidated revenue. If included, the total may be about $1.2 billion.

Shinko Denki Industry had $933 million in revenue from its IC Package division, which consists of high-end flip-chip BGA (mostly for Intel), regular BGA, IC assembly and module circuits (mostly camera modules). Although the company does not state sales of each sector, it is generally understood that its IC assembly and camera module business was about $130 million.

Meiko Electronics came out of a forced shutdown of its plant #2 in Wuhan (Apple-related incident), which is doing well with HDI boards for Chinese smartphone makers now. Its automotive PCB business is strong. The Vietnam plant has recovered from the fire that took place at the plating area. (How many fires have occurred in plating areas in the past several years?) In May this year, Meiko purchased Panasonic’s Vietnam ALIVH factory, which was shut down on January 1, 2014. Vietnam plant’s third floor is dedicated to a JV between Meiko and Schweizer Electronics of Germany for automotive PCBs.

MFlex has reorganized its operations by shutting its Chengdu FPCA plant. It has been diversifying its customer base to avoid dependence on a single client.

There’s no doubt AT&S’s future is in China. No material expansions seem to have been made in India, South Korea or Austria. Its original plan to build smartphone HDI boards at its Chongqing plant has changed; now that site is earmarked for IC substrates and will see more than $500 million in new investment. The Chongqing plant may be partially operational some time in 2015. It seems that AT&S is counting on IC substrates and embedded component PCBs for its future growth, although historically it depended heavily on HDI boards for cellphones. Automotive PCBs are another area AT&S is betting on.

CMK is the top automotive PCB maker in the world. It manufactures is “reliability” products, “surprisingly” because its main products have been traditionally for consumer electronics. It shut its single-sided plants in Singapore and Indonesia a long time ago. Now, it has decided to shut its Malaysian plant, which made aluminum boards for LEDs. CMK’s only Southeast Asian plant left is in Thailand, dedicated to automotive PCB manufacture. Expansion and upgrades to its Thailand and China plants are being carried out.

T.P.T. (Taiwan PCB Techvest) owns Yang An, which is listed separately. Yang An, which has been listed in NTI-100 in the past, is now erased from the table. T.P.T. is still strong in what Taiwan calls “optoelectronics PCB,” a fancy way of saying LCD driver PCB, although the maker has been strongly involved in the notebook motherboard business in recent years.

Wus Group consists of an HDI plant in Kaoshiung, Taiwan, and a high-layer count Kunshan plant (plus automotive PCBs also in Kunshan). It completed the brand new plant (two connected factories) in the Qing Song part of Kunshan and has been building a plant in Huang Xi, Hubei Province, where Unimicron will build a plant in the future. Wus Kunshan is a major supplier to Cisco, Huawei, ZTE, Ericsson, Alcatel-Lucent, etc. It has been emphasizing automotive PCB. Wus’ production of MLBs with layer counts exceeding 18 layers exceeds $100 million per year.

Chin Poon Industrial is the second-largest automotive PCB maker, and it has a good chance in the very near future to overtake No. 1 CMK. It has been expanding HDI operations in Taiwan, building a second HDI plant for automotive applications and building a new plant in Thailand next to the existing DRACO plant, which is practically owned by Chin Poon. Chin Poon has been steady in revenue increase and yet maintains profitability. Not an easy task.

Gold Circuit Electronics recovered from a fire at its Changshu plant #1. Changshu plant #2 was purchased from Victory Circuit (Victory Taiwan plant was sold to Tripod, which recently reduced its share in Victory) and converted to an HDI plant. GCE Taiwan is a maker of high-layer-count MLBs. Its MLB production with layer counts more than 18 layers exceeds $100 million annually.

Kyocera PCB Group consists of Kyocera SLC (originating from IBM Yasu) and Kyocera Circuit Solutions purchased from Toppan-NEC Circuit Solutions in October 2013. Kyocera is the world’s largest ceramic package substrate maker (more than $1 billion?), but the ceramic portion of the revenue is excluded from the estimated $600 million total. It inherited a plant in the Philippines when it purchased Toppan-NEC last October. This plant was built two decades ago by NEC, and in recent years has been used as a final inspection plant for Toppan-NEC’s IC substrates. No decision seems to have been made by the new owner as to what to do with it.

LG Innotek is a supplier of any-layer HDI boards to Apple. Its IC substrate division has Qualcomm as its major customer. It was one of the most capable makers of high-layer-count MLBs in South Korea, but for some reason it exited this market.

ISU-Petasys consists of Petasys, which is the largest high-end MLB supplier to Cisco, Exaboard, Exaflex, Petasys America and TTL. TTL is the former Trendtronic, located in Hunan Province, about 100km south of Changsha. Petasys is expanding its high-layer-count MLB capacity in Taegu, Korea. “Isu” means “pear tree” in Korean, in case the reader is wondering. ISU Chemical is the parent.

Nitto Denko is the largest supplier of FPC parts of HDD suspension drives. Its printed circuits output in 2013 was $555 million, up from $413 million in fiscal 2012.

Unitech is one of the leaders of high-end HDI boards. It is also promoting automotive PCB. It is one of the top rigid-flex circuit makers in Taiwan (in the form of “semi-flex,” in which the flexible part is made from thin FR-4, instead of the usual polyimide). Its Shanghai plant will be relocated to Nantong in 2017-2018. The current site will be a huge exhibition center, larger than the exhibition center in Pudong, Shanghai.

Shennan Circuits is one of the major suppliers of high-layer-count MLBs. It belongs to AVIC (Aviation Industry of China). It has been building a large plant in Wuxi for IC substrates and HDI boards.

Fujikura Corp. has been recovering from severe flooding damage in Thailand in 2011. Two damaged plants have been reconstructed. Fujikura built a new flex circuit plant in Thailand and purchased an FPC plant in Ho Chi Minh from bankrupt Sakai Denshi. It is aiming at $550 million to $600 million revenue in fiscal 2014. The plant in Japan accounts for only 5% of Fujikura’s total capacity.

Founder Technology expanded its HDI operations at its Doumen Fushan campus and built a new QTA plant, also at Doumen campus. It is one of the largest HDI board suppliers in China, mostly to Chinese smartphone makers. Its Chongqing plant is dedicated to high-layer-count MLBs. The parent of this maker is Beijing University.

Dynamic Electronics changed its image in 2013 from original “DYnamic.” Its recent emphasis is on profit versus revenue growth, by expanding HDI products and automotive PCBs.

CCTC is one of the major China-based HDI board makers, but somehow its revenue growth in the past few years is dormant. It is part of Go-World. Its sister division manufactures laminates.

Kinwong has been growing rapidly in the last few years by adding FPC and metal core PCB capability.

DAP had a big fire at its Anseong, Korea, plant in March this year. It is one of the major suppliers of HDI boards to Samsung Electronics. It started to build a new plant next to the burned plant, and the first phase seems to have been completed.

KCE is expanding automotive PCB capacity by building a dedicated plant (first phase) next door to a KCE’s group company, Thai Laminate, in Lat Krabang near Bangkok Airport. More than 70% of its output goes to the automotive industry.

Tigerbuilder is a China-based HDI board maker located in the Wuzhong district of Suzhou. It is formerly Ya Shin of Taiwan, which went bankrupt. Ya Shin’s Dongguang plant was purchased by China-based Wuzhou. During its heyday, Ya Shin DG manufactured millions of MLBs for Sony PlayStation game consoles. Tigerbuilder deals with about 80 Chinese smartphone makers, out of 377 licensed in China. (This number may have changed.)

Palwonn is a Taiwan-based company with plants only in China. Its origin is APCB Shenzhen. The major owner is an entrepreneur with shares in various PCB-related companies in Taiwan and China. It has two plants: one in Shenzhen, the other in Suzhou. The Suzhou plant is brand new and very large.

Gul Technology, a Singapore-based maker with plants in Suzhou and Wuxi, is expanding in Wuxi by building a new plant. Its Suzhou plant is mainly for automotive, while Wuxi is for HDI boards for DSC, etc.

NTK’s interconnect product consists of ceramic and organic package substrates. Some $100 million represents only organic package revenue. It owns at least 34% of Eastern, another mid-size package substrate maker in Japan. Eastern is constructing a new package substrate plant in Nagano Prefecture in Japan with money from NTK.

There are more than 20 fabricators with revenues between $90 million and $99 million. Their revenues are so close to each other that ranking them accurately is almost an impossible task because of exchange rate effects.

In 2013, 14 PCB manufacturers achieved revenues of more than $1 billion, one more than in 2012. Four attained more than $2 billion. If SEMCO maintained its 2012 output level, there would have been five with more than $2 billion revenue.

Taiwan makers continue to expand in China, albeit more cautiously. However, if these expansions are examined carefully, one can notice that many of these are replacements of original plants that are no longer expandable due to water regulations, be they water supply limits or waste treatment rules. Many of the “original plants” were constructed in “loosely defined” industrial parks, which are now surrounded by residential houses, and the residents complain about smells from the plants and potential environmental disasters due to the heavy metal usage by PCB makers. As a result, local governments are asking these plants to shut down. This is happening not only to Taiwanese fabricators but to manufacturers of all nationalities.

Chinese fabricators are now expanding more aggressively in China. It will be some time, however, before any China-based fabricator achieves revenue of $1 billion, unless some merge with or purchase competitors. The Japanese have stopped building new plants in China, although small expansions of existing plants can be seen. In the future, will more China-based makers creep up in the ranks? We shall see.

Sixteen years ago, fabricators were angling for a bigger piece of the telecom market. Today it’s smartphones. But the trend is still the same: The big get bigger – and faster.

is president of N.T. Information; nakanti@yahoo.com.

Press Releases

- Absolute EMS Earns ITAR Registration, Strengthening Manufacturing Capabilities for Military and Defense OEM Customers

- The ICAPE Group Announces the Launch of Its E-Shop at Electronica

- ESCATEC Pushes New Boundaries in Micro-Electronics with UV Enhanced Die Bonder Technology

- ViTrox Showcases Groundbreaking Inspection Innovations at NEPCON Asia 2024