Navigating Supply Chain Disruption: One EMS Provider’s Approach

The inventory problem is showing no sign of abating, requiring better tools and planning.

Over the past few months, electronics manufacturing services (EMS) providers have been seeing stock depletion in passives, in some cases stretching out to 52 and 63 weeks. Some power components and memories are going on allocation as well. And, while some parts remain at 26 weeks, weather-related disruptions have impacted inbound freight. While the human element of the devastation caused by the most active hurricane season on record should never be minimized or forgotten, the scale of the recovery from this season’s natural disasters will likely involve the manufacture of nearly a million products dependent on electronics from cars to appliances to consumer goods, in addition to the products normally built in a given year. This will likely exacerbate the already bad situation in passives, plus increase lead-times on other parts.

While the component manufacturing industry will increase some capacity, it is unrealistic to expect it to increase capacity to the levels needed to manufacture the short-term spike of replacement product demand driven by people replacing damaged goods. While specifying multiple sources, avoiding obsolete or near obsolete components, and sanity checking availability trends will help minimize availability impact in new products, the reality is component shortages will impact electronics manufacturing for at least the next year. A key workaround in that environment is the ability to rapidly identify alternative options if a part becomes unavailable.

TeligentEMS, a regional EMS provider headquartered in Tallahassee, FL, has long been focused on developing proprietary systems tools to minimize variation within its production operations and enable real-time monitoring of the entire product realization process. This approach offers the dual benefit of eliminating defect opportunities while reducing non-value-added “opportunity” costs related to poor quality, excess inventory, unneeded transactions and expedited freight. Additionally, it has helped the company redeploy people from administrative activities such as expediting late material into roles that better serve the customer.

Originally, the company opted to build proprietary tools around an Epicor ERP system to fill the gaps its team had identified in their overall systems strategy. Development efforts began with the creation of a single system known as Possible-X. The system started as a simple “what if” tool designed to integrate with the ERP system and quickly assess material availability of specific parts in existing inventory. Over time, this simple tool has grown to a suite of tools accessing a central repository for information.

This year, the Possible-X system was upgraded to a 2.0 version, taking into account user feedback for improvements in speed, capabilities and ease-of-use. Purchasing, inventory and materials management are now provided with instantaneous detailed information on purchased components from approved materials list (AML) to supplier cost information, order quantity, minimum order quantity and current on-hand, current on-order, on-hand dollars and excess inventory, to name a few. This enables users to quickly identify the inventory location and the next delivery. It also provides possible crosses for a component cost history, MRP requirement, where used, PO history, quote history and BOM detail.

This visibility is helping the purchasing team address the issues in passive components at two levels. First, the system is exception-based, so it alerts the right team member the minute an exception occurs. Second, the system provides the real-time visibility into available options both in inventory and within the supply chain by allowing buyers to search by part description, commodity or AML.

From the passive standpoint, most customers are open to crossing what they see as a commodity part, and so far the team has been able to find alternates in stock. Possible X 2.0 facilitates this by categorizing matches based on the commonality with the original part. A Type 0 match is an exact match manufacturer’s part number and date code. A Type 1 match exists if the AML lists three options and the part is only crossed to two by identifying additional crosses. A Type 2 match occurs when a portion of the characters in a part number match.

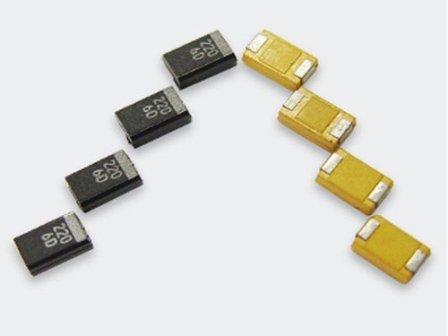

FIGURE 1. Lead-times of many parts such as tantalum capacitors are getting longer as demand increases.

The system also allows users to create a customized search tool that loads specified files from the MRP database and can be programmed to search specific component search engines. Problem parts can be stored as a list to be searched periodically. There is also a toolset that enables tracking of stock at distributors. To date, this level of system visibility has allowed the team to manage exceptions within customer delivery commit dates.

That said, it takes an OEM-EMS joint team approach to address component shortages. While a system like Possible X 2.0 makes it easy for buyers to identify a range of possible options for components with availability issues, OEMs must also provide timely approval of alternate sources. In a market where component demand exceeds manufacturing capacity, a delay in the approval of alternative inventory purchase can eliminate that opportunity.

The severity of the component availability situation will get worse. While this will be an industry-wide problem for a long time to come, there will be options for OEMs that take a proactive approach to forecasting and openness to alternate sources and EMS providers that utilize real-time systems to improve their visibility into available options.

is president and CEO of TeligentEMS(teligentems.com);celred@teligentems.com. is director of materials at TeligentEMS; jguon@teligentems.com.

Press Releases

- Phononic Launches Wholly Owned Subsidiary in Thailand as APAC Headquarters

- AIM Solder’s Dillon Zhu to Present on Ultraminiature Soldering at SMTA China East

- Hentec/RPS Publishes an Essential Guide to Selective Soldering Processing Tech Paper

- ZESTRON Welcomes Whitlock Associates as New Addition to their Existing Rep Team in Florida