Among Designers, Compensation, Job Satisfaction on the Rise

Though older (and perhaps wiser), PCB professionals are pleased with their career choice.

For years – decades, even – we’ve noted the graying of the printed circuit board design profession. If PCD&F’s latest data are any indication, more than half of today’s PCB designers plan to work in the field for no more than the next 10 years. Salaries are high – as is job satisfaction – but so are years of experience. More than two-thirds of respondents to our annual survey of designers now surpass the 20-year mark.

This year’s version of the annual PCD&F salary survey contained a few new questions as we sought to get a better handle on not just where designers have been, but where they are going. New this year were queries on how long they plan to continue in the field; what software they predominantly use; even whether they are stretching beyond traditional electronic design responsibilities (ECAD) into the mechanical domain (MCAD/enclosures).

The survey of bare board designers, managers and design engineers was conducted in early summer. We received 301 qualified responses. Data compiled included job titles and functions, years of experience, location, types of projects, annual salaries, annual sales, job satisfaction and challenges, and ECAD tools used, to name some. While year-over-year changes are shown, they are for comparisons only, and should not be assumed to be definitive.

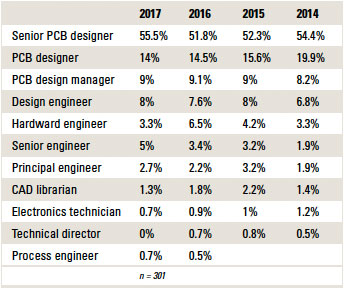

Of the 301 respondents, 56% said they are senior PCB designers, up from 52% last year, while almost 14% said their job title is PCB designer (TABLE 1). Nearly 9% of respondents are PCB design managers. Design engineers accounted for 8% of responses, and senior engineers made up 5% of respondents. The other measurable response was hardware engineers (3.3%); all other job titles accounted for less than 3% of responses each.

Table 1. Respondents by Job Title

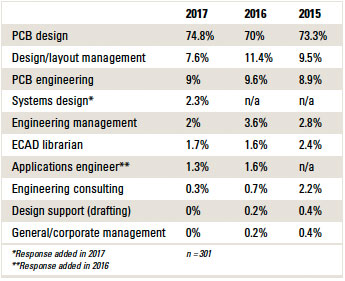

Job function. PCB design represents 75% of respondents’ principal job functions, including schematic, layout, placement, etc., up from 70% in 2016 (TABLE 2). Another 9% said their principal job function is PCB engineering, down slightly from 10% last year. Design/layout management accounted for 8%, down from 11% in the previous survey. Systems design was a new option on the survey, with 2.3% of responses. Engineering management accounted for 2% of responses, down from 4% in 2016. All other job functions were 2% or lower each.

Table 2. Principal Job Functions

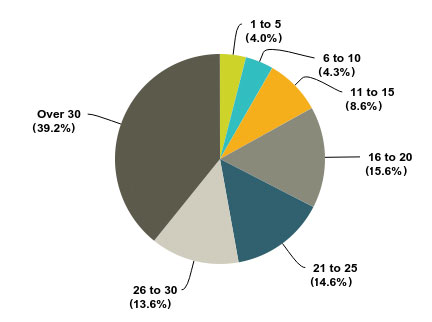

More than 39% of those who took this year’s survey said they have more than 30 years of experience in the field, compared to 35% in the prior year’s survey (FIGURE 1). Another 4% said they have 1 to 5 years of experience, flat with 2016. About 4% of respondents said they have 6 to 10 years’ experience, compared to 7% in 2016, and another 9% have 11 to 15 years of experience, flat with last year. Nearly 44% of respondents have 16 to 30 years of experience in PCB design, down about one percentage point compared to last year.

Figure 1. Years of experience.

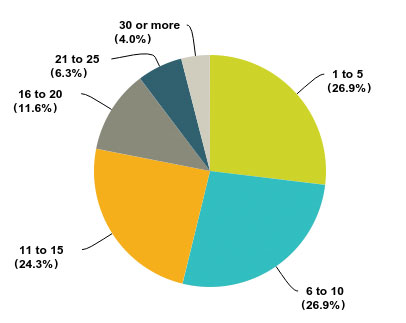

For the first time, PCD&F asked respondents how many more years they plan to work as a designer. More than a quarter (27%) plan to spend 1 to 5 more years in the field, and another 27% plan on 6 to 10 years (FIGURE 2). More than 24% said they plan to work 11 to 15 more years as a designer, and 12% said 16 to 20 years. Only 10% plan to work as a designer for more than 20 more years.

Figure 2. Years left as a designer.

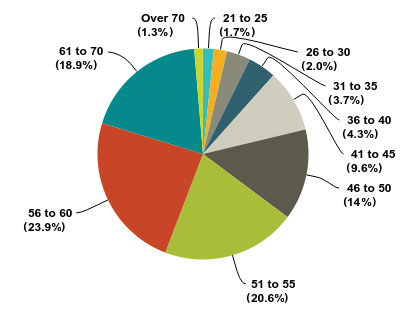

Age. A look at the demographics of the respondents to this year’s survey sharpens the picture into why retirement is looming. The majority (64%) are between the ages of 51 and 70, up from almost 60% last year (FIGURE 3). Another 24% said they are between 41 and 50, up slightly from 22% in 2016. A total of 8% are between the ages of 31 and 40, down from 12% last year. Only 4% of respondents are 30 or under. In addition, 90% of this year’s survey respondents are male.

Figure 3. Current age.

The good news: 75% said their job gives them significant fulfillment. The survey didn’t attempt to discern what made respondents’ jobs fulfilling, however. (More on that below.)

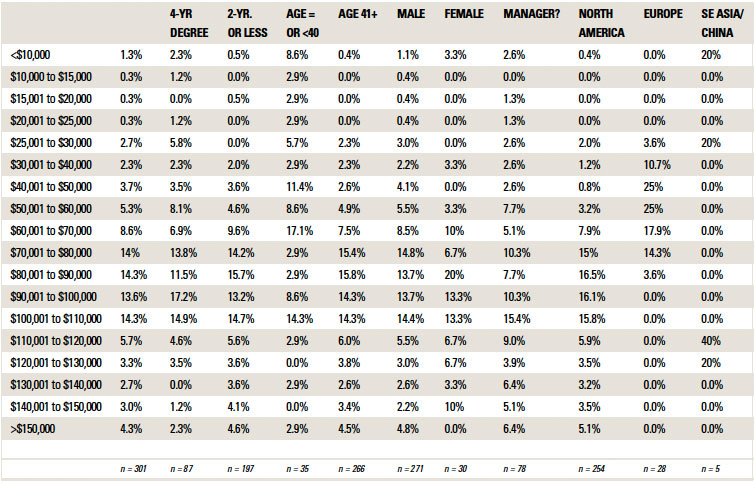

Salary. Certainly, getting paid well can add to job satisfaction. And designers do tend to be paid very well relative to many professions. The majority of designers’ salaries fell in the $70,001 to $110,000 range (in US dollars) (56%), up from 52% in 2016 (TABLE 3). The median salary range was $80,000 to $90,000. Some 19% make more than $110,000, down slightly from 20% in the prior survey. Fourteen percent of designers said their salaries fall between $50,001 and $70,000, flat with last year.

Designers making $50,000 or less represented 11% of responses, compared to 14% in 2016.

Table 3. Average Annual Salary, by Segment

This year PCD&F asked designers if they are at or above the top of their company’s salary range for their job/position. Some 52% said “yes.”

Just under half of respondents (49.5%) said they receive an annual bonus, down from nearly 52% last year. Of those who receive a bonus, 45% said it’s between 1 and 3% of their annual salary, compared to 43% last year. Another 27% said it’s between 4 and 7% of their salary, down from nearly 30% in 2016. Bonuses above 7% of annual salaries accounted for 29% of responses, up from 27% last year.

When asked how their salaries changed in the past year, the predominant response was salaries rose 1 to 3% (58%), up from 50% in 2016. Some 11.6% said salaries rose 4 to 6%, down from 14% in the previous survey. Four percent of salaries rose seven to 10%, according to survey data, down from 6% last year. Another 6% said salaries rose more than 10%, compared to 5% in 2016. Nearly 18% said their salary hasn’t changed, down from 21% last year. Only eight respondents said their salaries fell.

Benefits. Survey respondents were asked what educational opportunities their companies support and checked all that apply. Opportunities increased across the board in 2017, with on-the-job training receiving the highest amount of responses, with 66%, up from 58% last year. Classes at conferences came in second, with 64%, up from 55% in 2016. More than 60% said their company offers tuition reimbursement, compared to 58.5% in the prior survey. Company-sponsored classes accounted for 47% of responses, up from 42% last year, and 45% of respondents said their firm offers mentoring, up from 33% in the prior survey. College classes are offered by 23%, a slight increase from 22%, and 12% said educational opportunities at their companies are not applicable, down from 17% in 2016.

The benefits picture for designers is strong in 2017 as well, with 89% of companies providing health insurance, according to survey data. This is up slightly from last year’s total. Three-quarters or more offer dental insurance, 401(k) plans and life insurance. Other benefits include:

- Cafeteria: 48% (47% in 2016)

- Exercise room/equipment: 38% (35%)

- Telecommuting: 36% (30%)

- Stock purchasing plan: 32% (35%)

- Company pension or retirement plan: 29% (27%)

- Relocation expenses: 25% (18%)

- Profit sharing: 24% (21%)

- Sabbatical: 9% (7%)

- Daycare facilities: 5% (6%)

- N/A: 5% (6%)

New to the survey this year, PCD&F asked, “How have your benefits changed in the past year?” Some 52% said their benefits haven’t changed. Another 8% said more or the same benefits were offered this year, but at a lower cost, while nearly 40% said fewer or the same benefits were offered in 2017 but at a higher cost.

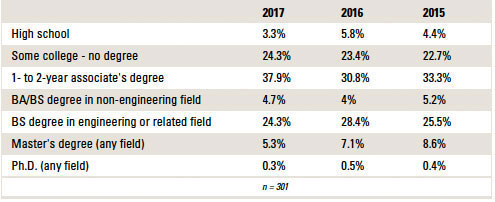

Education. Nearly 38% of respondents said they have a one- to two-year associate’s degree, compared to 31% in 2016 (TABLE 4). Those with a bachelor’s in engineering or a related field accounted for 24% of responses, down from 28% last year. Some 24% said they have “some college” experience, but no degree, slightly up from 23% in the prior survey. About 3% said their highest level of education is high school, down from 6% last year. More than 5% of respondents said they have a master’s degree, compared to just over 7% last year, and one respondent has a Ph.D.

Table 4. Highest Level of Education

For those who have degrees from four-year colleges, these are the subjects their degrees are in:

- Electrical engineering: 66% (69% in 2016)

- Liberal arts: 6% (3%)

- Mechanical engineering: 5% (4%)

- General/chemical/industrial/other engineering: 3% (6%)

- Physics: 3% (1.4%)

- Mathematics: 3% (2.4%)

- Business: 1.7% (1.4%)

- Other: 13% (13%)

Certifications. Forty percent of respondents are IPC certified designers, up from 37% last year. Of those certified, 60% are CID, compared to 58% in 2016, and 39% are CID+, down from 42% in the previous survey.

Employment. Some 95% of respondents have the same job as 2016, flat with last year’s results. Two percent of those who took the survey said they were laid off in the past year, also flat with the prior survey.

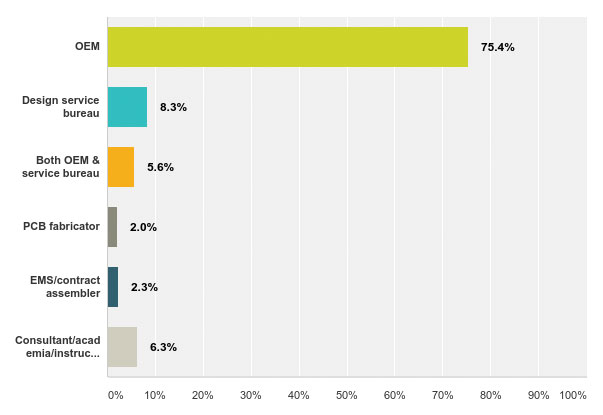

Respondents predominantly work for OEMs (75%), compared to 73% in 2016 (FIGURE 4). Some 8% said they work for a design service bureau, compared to 11% last year. Another 6% work for both an OEM and design service bureau, down from 7% in 2016, and 6% said “consultant/academia/instructor/other,” up from 5% in the prior survey. Those who work for an EMS/contract assembler accounted for 2% of responses, nearly flat with last year’s results, while 2% work for a PCB fabricator, up from 1% in 2016.

Figure 4. Company types.

When asked how many total employees their company employs worldwide, 60% of respondents said more than 1,000, up from 55% last year. Another 15% said their company has 251 to 1,000 employees globally, compared to 13% in 2016. Some 6% said 101 to 250, down from 9% last year, and another 6% said 51 to 100, down from 7% in 2016. About 7% have 10 to 50 employees in their company, and slightly more than 6% have 9 or fewer.

More than 22% of respondents’ companies have total approximate annual sales of $5 billion or more, nearly flat with last year. Nearly 14% have annual sales of $5 million to $49.9 million, down from 16% in 2016, while 13% have sales of $1 billion to $4.9 billion, compared to 13% last year. Ten percent of designers’ companies have annual sales between $100 million and $499.9 million, up from 9%. Another 20% are unsure of their company’s sales.

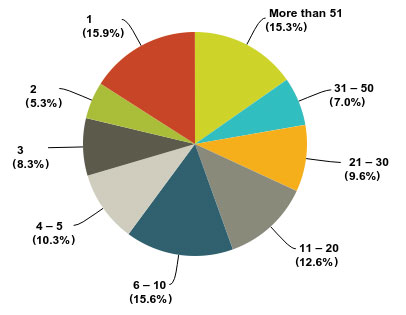

The respondents’ companies employ six to 20 circuit board designers globally at a rate of 28%, up from 24% last year. Sixteen percent employ only one designer, and another 15% employ more than 51 designers, both roughly flat with 2016. Some 10% have four to five designers, while 10% have 21 to 30. Others responses are included in FIGURE 5.

Figure 5. Designers employed worldwide at the respondent’s company.

Location. More than 75% of the designers who responded to this year’s survey are located in the US. By region, it breaks down as Midwest (21%), West Coast (including Arizona) (21%), Northeast/New England/Mid-Atlantic (18%), Southeast (12%), Rockies (6%), and Plains states (2%).

Outside the US, Central/Western Europe was the most common location, at 8%, followed by Canada (4%) and India (3%). Respondents from all other locations received less than 2% of responses each.

Some 88% of respondents’ companies employ circuit board designers in North America, up from 86% last year. Another 31% employ designers in Europe, flat with 2016. Companies that employ designers in Southeast Asia (but not China) accounted for 20% of responses, compared to 22% last year. China-located designers were up to 21%, compared to just over 15% in the previous survey. Japan received 6% of responses, while Africa received 1%.

Some 74% of designers who took the survey said no one reports to them directly, up from 70% in the prior survey. Another 22% have one to five people reporting to them, compared to 23% last year. Only 2% said they have six to 10 employees reporting directly to them, down from 4% in 2016, while 2% are responsible for 11 to 20 staff members, nearly flat with last year’s results. Two respondents have more than 20 people reporting to them.

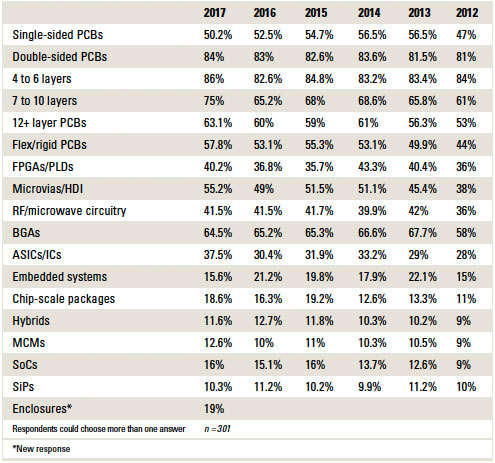

Responsibilities. Designers were asked what types of projects and/or technologies they directly engineer, design or layout; they chose all that apply (TABLE 5).

Here are their responses. Note the percentage handling mechanical designs.

- Single-sided PCBs: 50% (53% in 2016)

- Double-sided PCBs: 84% (83%)

- 4 to 6 layers: 86% (83%)

- 7 to 10 layers: 75% (65%)

- 12-plus layer PCBs: 63% (60%)

- Flex/rigid PCBs: 58% (53%)

- FPGAs/PLDs: 40% (37%)

- Microvias/HDI: 55% (49%)

- RF/microwave circuitry: 42% (42%)

- BGAs: 65% (65%)

- ASICs/ICs: 38% (30%)

- Embedded systems: 16% (21%)

- Chip-scale packages: 19% (16%)

- Package-on-package: 8%*

- Hybrids: 12% (13%)

- MCMs: 13% (10%)

- SoCs: 16% (15%)

- SiPs: 10% (11%)

- Enclosures: 19%*

- None of the above: 0.3% (0.7%)

*New response

Table 5. Projects and Technology Trends

On average, 28% of respondents produce six to 10 new designs annually, up from 26% last year. Another 19% produce 11 to 15 new designs per year, down about one percentage point from 2016. Nearly 18% produce one to five new designs each year, nearly flat with last year’s results. Of the power users, 14.6% said they produce 16 to 20 new designs each year, down from 16.1% in 2016. Nearly 20% said they produce more than 20 new designs annually, flat with last year.

Respondents said they primarily design for these end-markets:

- Government/military/aerospace/avionics/marine/space: 22% (21% in 2016)

- Industrial controls/equipment/robotics: 16% (19%)

- Consumer electronics (includes wearables and white goods): 14% (10%)

- Communications/related systems equipment (includes all phone types): 10% (16%)

- Computers/peripherals: 8% (6%)

- Electronic instruments/ATE design and test: 7% (7%)

- Automotive/other ground vehicles: 6% (6%)

- Medical/optical electronics equipment: 5% (7%)

- Semiconductor and related packaging: 3% (4%)

- Other: 9% (5%)

Challenges. When asked about designers’ biggest challenges for 2017, answers remained similar to last year. Job security seems to be improving among our sample. Respondents chose all that apply.

- Workload: 57% (58% in 2016)

- Technology: 39% (36%)

- Finding/keeping job: 22% (27%)

- Outsourcing: 20% (18%)

Purchasing power. Respondents were asked which product/service purchases they evaluate, recommend, specify, or approve, and they checked all that apply. This year ECAD software garnered 76% of responses, a downward trend from a year ago. Prototype PCB services received 53% of responses, while volume PCB fabrication services gathered 29% of responses, nearly flat with last year. Design services came in at 33%, down from 38%, and assembly services received 32% of responses, flat with last year. Some 31% of respondents noted CAM software, up from 25% in 2016. Connectors and cables came in at 28%, down from 30%. The rest of the responses are as follows:

- Active/passive components: 26% (31% in 2016)

- Substrate materials: 21% (24%)

- Solder mask: 18% (21%)

- CAE software: 18% (19%)

- Computers and peripherals: 16% (20%)

- MCAD software: 13%*

- Solder materials (paste, flux): 13% (15%)

- FPGAs/PLDs: 12% (14%)

- Test/measurement services: 12% (15%)

- Consulting services: 11% (15%)

- Epoxies and finishes: 11% (14%)

- None of the above: 14% (11%)

*New response

When asked their highest level of purchase power, 32% said they recommend products, 26% said they evaluate products, 17% specify products, and more than 9% approve product purchases.

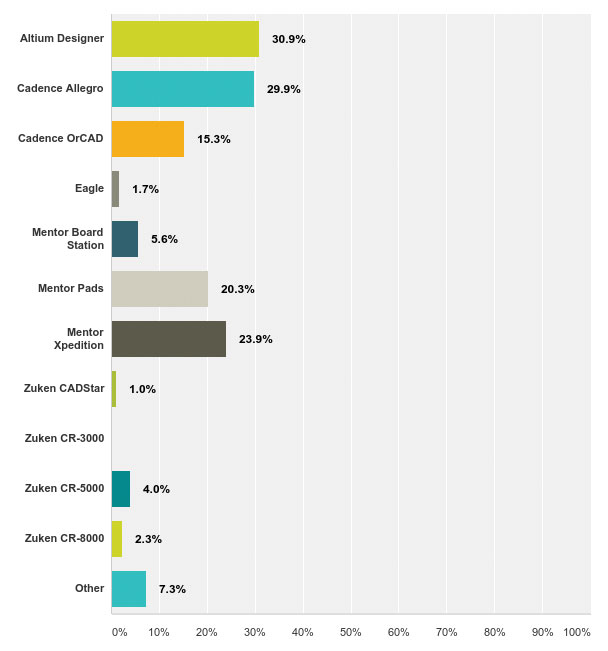

Software. Mentor, Cadence and Altium are the trifecta of ECAD tools for today’s printed circuit board designers, according to the survey. A new question on the 2017 survey asked which kinds of ECAD tools designers use on at least a weekly basis. Half the designers surveyed use some form of Mentor software weekly, and yearly, Mentor software is used by nearly 54% of those who completed the survey. Cadence software is second, with 45% of designers surveyed using one of the company’s products weekly, and nearly 50% at least once annually. With nearly 31% of respondents using Altium’s software on a weekly basis and 35% annually, the design software company came in third overall.

By flow, Altium Designer received the most responses, with 31% (FIGURE 6). Cadence Allegro was a close second, with almost 30%. Mentor XPedition came in third, with nearly 24% of responses, and Mentor Pads received 20% of responses. Cadence OrCAD accounted for 15% of responses, and Mentor Board Station came in at 6%. Other E-CAD tools include Zuken CR-5000 (4%), Zuken CR-8000 (2%), Eagle (2%), and Zuken CADStar (1%). “Other” received 7% of responses.

Figure 6. Weekly E-CAD tools used.

When asked which E-CAD tools designers use at least once a year, the answers were as follows:

- Altium Designer: (35%)

- Cadence Allegro: (30%)

- Mentor Pads: (24%)

- Mentor XPedition: (22%)

- Cadence OrCAD: (19%)

- Mentor Board Station: (8%)

- Zuken CR-5000: (3%)

- Eagle: (3%)

- Zuken CR-8000: (2.3%)

- Zuken CADStar: (1.7%)

- Other: (12%)

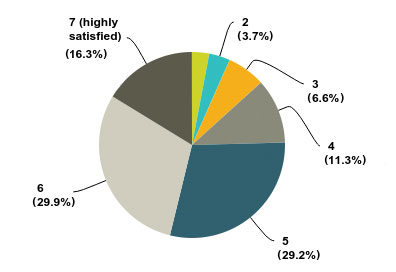

Job satisfaction. Ultimately, what will keep designers in their seats is job satisfaction. On a scale from 1 to 7, with 1 being lowest and 7 being highest, most in the profession are generally pleased with their jobs. More than 16% rated their job satisfaction as “highly satisfied” with a score of 7, flat with last year’s results, while 30% rated job satisfaction with a 6, also flat with 2016 (FIGURE 7). More than 29% gave job satisfaction a 5, up from 26% last year. The downside: About 21% said 2, 3 or 4. Only 3% said they are “completely dissatisfied” with their jobs.

Figure 7. Job satisfaction.

All in all, it adds up to a profession that is busy but happy in their chosen path.

is senior editor for PCD&F; cdrysdale@upmediagroup.com.

For a look at past salary surveys, click here.